13 Sep 2024

SOURCE: CPF Board

If you provide ride-hail or delivery services through platform operators, you can look forward to improved support for your housing and retirement needs from 1 January 2025.

Read on to learn more about the changes to the CPF system for platform workers!

Changes to the CPF system for platform workers

Increase in CPF contributions for platform workers born on 1 January 1995 or later

From 2025 to 2029, CPF contributions for platform workers born on 1 January 1995 or later will be gradually aligned to the prevailing CPF contribution rates of 20% of wages for employees and 17% for employers.

The CPF contribution will be calculated based on platform workers’ net earnings, which is derived by deducting the fixed expense deduction amount (FEDA) from their gross earnings.

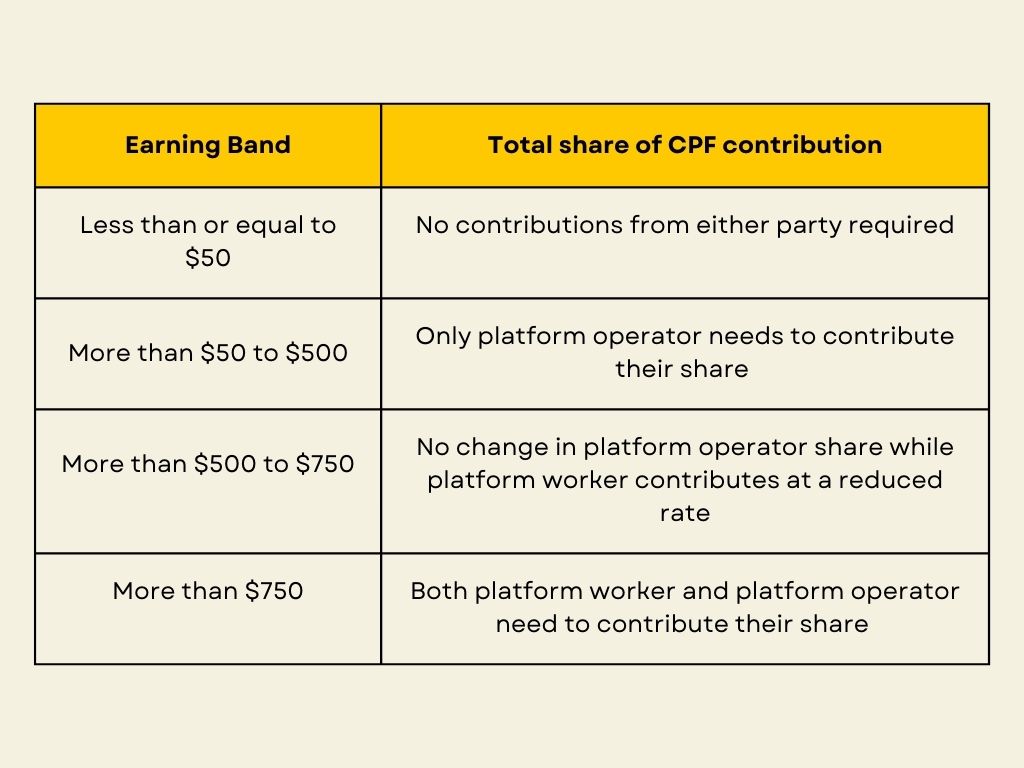

If you are a platform worker that is born on 1 January 1995 or later, refer to the table below to learn more about how your total share of CPF contributions will be affected:

Platform workers born before 1 January 1995 can opt in to increase their CPF contributions

Platform workers born before 1 January 1995 will continue to contribute to their MediSave Account only.

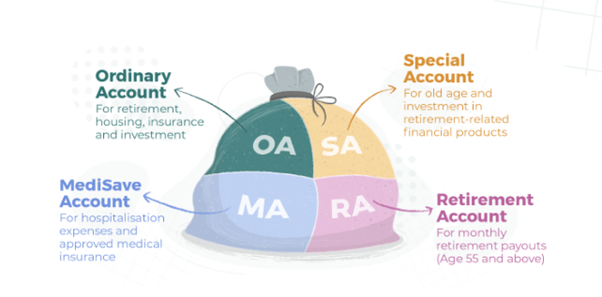

However, they can opt in to contribute to all three CPF accounts (OA,SA,MA) and receive the same total share of CPF contributions as those born on 1 January 1995 or later.

CPF contributions to your Ordinary Account (OA) can be used to support home purchases, freeing up more cash for daily expenses. Contributions to the Special Account (SA) and MediSave Account (MA) can be used for retirement and healthcare needs.

You can opt in at any time using this page. There is no deadline for opting in, but note that once you opt in, the decision cannot be reversed.

Why the need for CPF contributions?

CPF contributions help ensure financial stability and support for you throughout your life.

Think of it as a community garden that provides support when you need it. Just as planting seeds in a garden result in luscious crops that grow over time, your CPF contributions continue to grow during your working years and can be "harvested" when you reach retirement age or have essential needs such as buying a home.

Without this community garden, you would have to budget and plan for everything by yourself, including saving for your housing, retirement, and healthcare needs.

Government support for a smoother transition

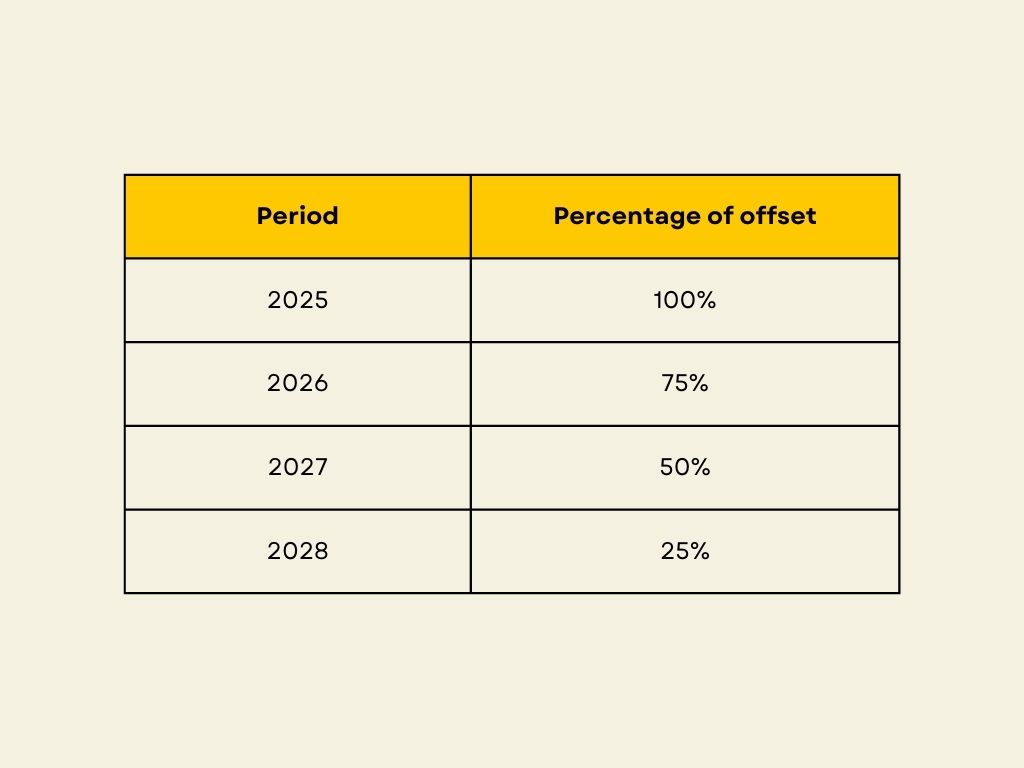

The Platform Worker CPF Transition Support (PCTS) will fully offset the increase in the platform workers’ share of CPF contributions for lower income platform workers in 2025. The offset will taper down gradually from 2026 to 2028.

Lower income platform workers earning $3,000 and below who are born on 1 January 1995 or later, or who are born before 1 January 1995 and have opted in to increase their CPF contributions will receive PCTS.

For eligible platform workers, PCTS will offset up to 100% of the increase in the platform worker’s CPF OA and SA contribution rates in 2025 to cushion the impact.

The exact years may change depending on the schedule of aligning platform workers’ CPF contribution rates with employees

The monthly PCTS cash payments will mitigate the concerns in take-home pay as platform workers contribute more to boost their retirement savings.

Learn more about the other eligibility criteria for PCTS and its full details.

Workfare Income Supplement (WIS) to be received monthly instead of annually

Platform workers eligible for Workfare Income Supplement (WIS) payments will receive them monthly instead of annually from March 2025. This is because platform workers will have their CPF contributions deducted more frequently by platform operators.

With effect from 2029, eligible platform workers whose CPF contribution rates are aligned with those of employees will receive increased WIS payments. This matches the amounts paid to employees.

They will receive 40% of their WIS payments in cash and the other 60% in their CPF accounts.

The increase in frequency and amount of WIS payments will provide eligible platform workers with both cash and CPF savings to help supplement their income and prepare for their future needs more adequately.

Healthy financial habits for platform workers

1. Track your income and expenses

Managing your money starts with understanding where it's going. Record your expenses and categorise them into essentials like housing and food, and non-essentials like entertainment.

At the end of the month, review your finances to determine the areas that you might be overspending on.

2. Set aside an emergency fund

An emergency fund acts as a financial safety net to help financially protect you from unforeseen circumstances. As a rule of thumb, you should aim for between three to six months' worth of living expenses.

Saving consistently, no matter how small, will help you build this fund over time and give you that extra peace of mind for unexpected expenses like medical bills or vehicle repairs.

3. Look into investment options

Starting early and investing regularly can help meet your financial goals. Contrary to popular belief, you don’t need a lot of money to start investing.

Low-risk options like Treasury bills and Singapore Saving Bonds are a great way to start investing and help grow your money steadily. You can also consider setting up a regular investment plan to invest consistently and reduce fluctuations in the market.

The information provided in this article is accurate as of the date of publication.