For platform workers born before 1 January 1995, you may opt in to increase your CPF contributions here.

You are a platform worker (PW) if you

- provide ride-hail or delivery services under a platform work agreement with a Platform Operator (PO), and receive a payment or benefit; and

- are under the management control of the PO when providing the platform service

For all platform workers

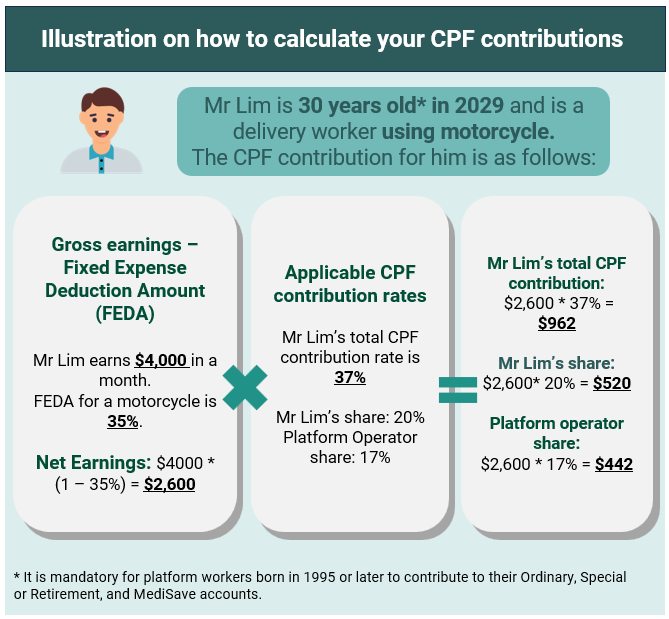

Your platform operator will deduct your CPF contributions as and when you earn and submit them to CPF Board every month.

Do verify your CPF contributions every month so that any errors can be rectified as early as possible

If you are not satisfied with your platform operator’s explanations, or if your platform operator is not cooperative, you can contact the CPF Board for assistance.

The Platform Workers CPF Transition Support (PCTS) will be provided from 2025 to 2028 as the CPF contribution rates for platform workers are gradually increased to align with employees.

PCTS will provide monthly cash support to offset part of the year-on-year increase in contribution rates to platform workers’ CPF Ordinary and Special or Retirement Account.

Eligible lower-income platform workers will receive Workfare Income Supplement (WIS) payments monthly instead of annually from 2025.

Eligible platform workers who are mandated or opt in to the increased CPF contribution rates will receive higher WIS payments at the same level as employees from 2029, once their CPF contribution rates fully align with that of employees. They will also receive a higher proportion of WIS payments in cash - 40% compared to 10% today.