7 Jun 2024

SOURCE: CPF Board

Here are some key terms on how to grow your CPF savings for your future needs. It’s just not the ones you already know!

Being zai in your financial calculations

Whether you're working towards home ownership, planning for healthcare expenses, or charting your retirement course, there's always a CPF tool that can guide you. Here are some key resources that can help you make informed decisions and achieve your financial goals:

CPF housing usage calculator: Use this calculator to help you gauge how much Ordinary Account (OA) savings you can use to finance your home purchase.

MediSave and MediShield Life claims calculator: This calculator helps you estimate potential MediSave and MediShield Life claims for various medical procedures.

CPF planner: Plan your financial roadmap, project, and maximise your CPF savings with this tool.

These handy tools are just a starting point! The CPF website has a comprehensive library of educational resources, including articles, guides, and podcasts to provide all the financial planning knowledge you need.

Mai tu liao and start growing your CPF savings

Your CPF savings benefit from stable compound interest rates, offering up to 6% per annum* if you're above 55 or 5% per annum* if you're younger. Imagine your money growing steadily over time, providing a solid foundation for your future housing, healthcare, and retirement needs.

The longer your money stays in your CPF, the more compound interest works its magic. It's like watching your savings snowball – the earlier you save, the more it grows! So don’t delay and top up your CPF!

Find out how to maximise your CPF interest.

*Based on the current 4% interest rate floor on Special, MediSave and Retirement Account monies. The interest rate for Special, MediSave and Retirement Account is 4.05% per annum from 1 April 2024 to 30 June 2024.

Boleh to give your CPF savings a further boost

Did you know you can potentially grow your retirement savings faster by transferring funds from your Ordinary Account (OA) to your Special Account (SA)? The SA offers a higher interest rate, currently up to 5% per annum.

Here's an example: transferring $20,000^ from your OA to SA could potentially earn you an additional $4,100* in interest over 10 years. Boleh!

Learn more about CPF interest rates.

^Projected based on the assumption you have $20,000 in your OA and $30,000 in your SA. Amount rounded down to the nearest $100.

*Based on the current 4% interest rate floor on Special, MediSave and Retirement Account monies. The interest rate for Special, MediSave and Retirement Account is 4.05% per annum from 1 April 2024 to 30 June 2024.

Share-share your home purchase

Buying a home is a significant milestone, often marking the beginning of a shared future with your partner. It’s a purchase that may require the sharing of financial responsibility to create a space that truly belongs to both of you.

While your CPF savings can be a valuable tool for paying for a home, it doesn’t have to shoulder the entire load. Consider a combination of both cash and CPF, if possible.

Don’t let your CPF savings bear all the cost of your home. You can share-share the amount and consider a combination of both cash and your CPF savings to maximise the benefits of both options – building a liquid emergency fund and boosting your retirement income.

Learn more about using your CPF to buy a home.

Got your basic healthcare needs covered liao?

Think of your MediSave Account (MA) as your health companion through life. It works alongside the Basic Healthcare Sum (BHS) to help manage your healthcare expenses.

The BHS is the estimated savings you need in your MA for your basic subsidised healthcare needs in old age. The prevailing BHS is $71,500 for CPF members who turn 65 in 2024 and it is adjusted annually for members under age 65 to match the growth in MediSave usage.

You can choose to top up your MA using cash if you would like to build up your healthcare savings faster. However, even if you have less than the BHS at age 65, you are not required to top up your MediSave Account (MA).

Note: Your retirement payouts come from your Retirement Account (RA), not your MA. Hence, regardless of whether you meet the BHS limit, it will not affect your payouts.

Find out more about saving more for your healthcare needs.

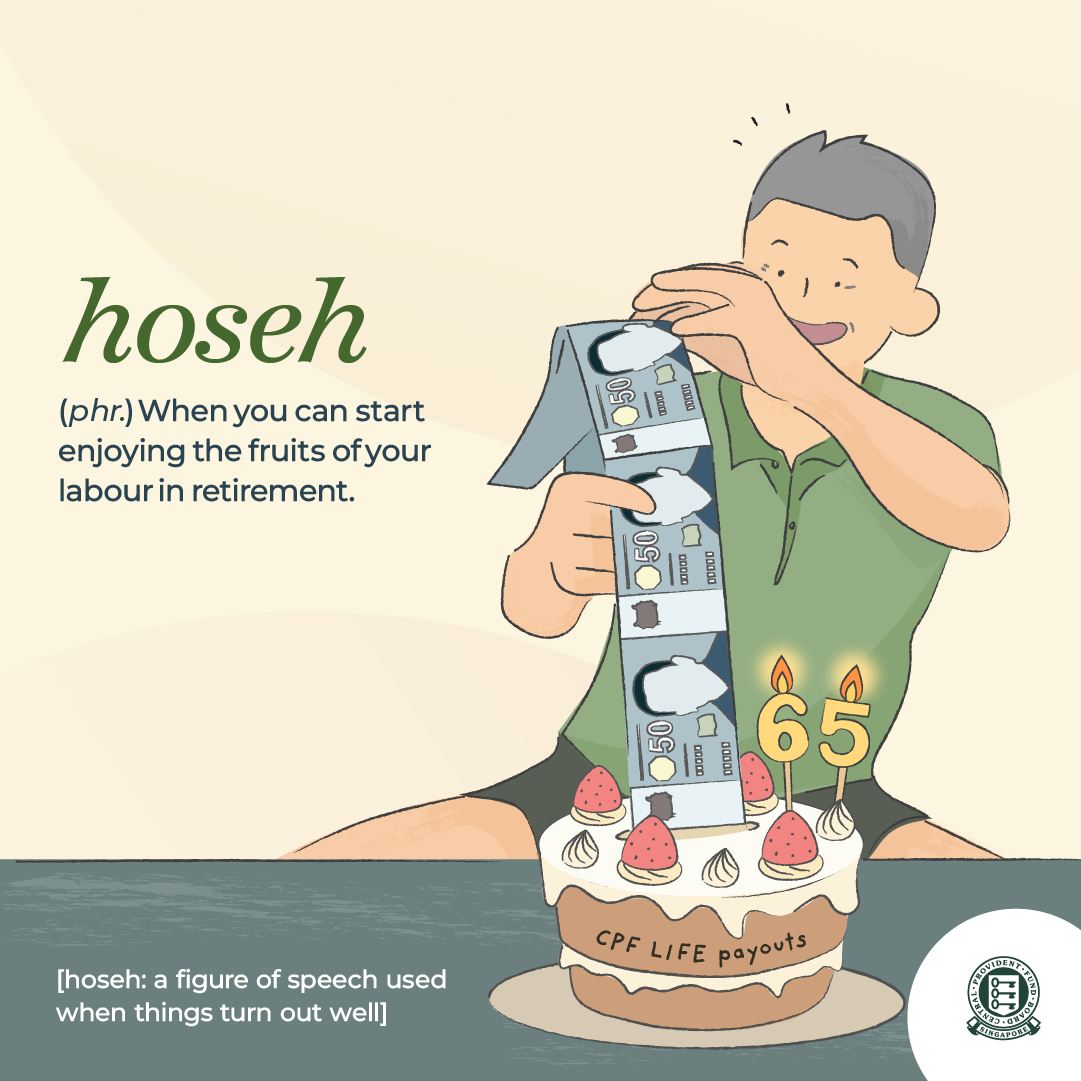

Retiring well? Hoseh

It’s time to reap the fruits of your labour after years of growing your savings!

Your CPF LIFE payouts provide a steady and lifelong income stream to support your preferred retirement lifestyle. Whether it's an active, adventurous lifestyle or a more relaxed pace, these payouts give some financial support to help make it a reality.

Find out more about CPF LIFE.

Information in this article is accurate as at the date of publication.