4 Sep 2024

SOURCE: CPF Board

Whether you’re just entering the workforce, have a family to care for, or are nearing retirement, your retirement savings are something to keep an eye on. Plan ahead to make the most of your CPF, because your monthly retirement payouts play a crucial part in supporting you to live your desired retirement lifestyle!

Read on for a quick refresher to consolidate your understanding of CPF. Let’s go back to the basics of CPF and learn how it can aid you in your retirement planning!

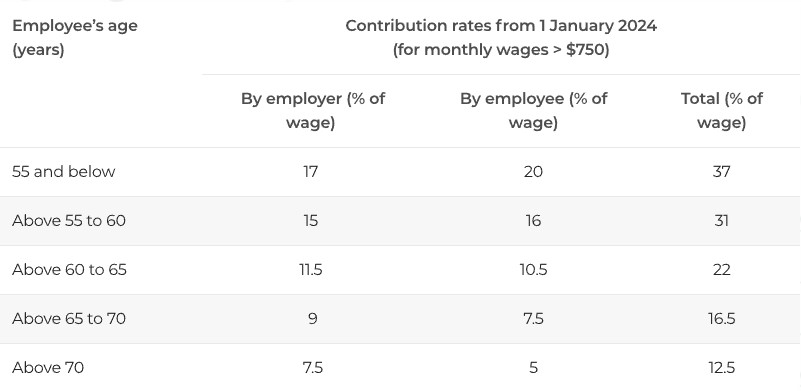

As a Singaporean or Singapore Permanent Resident, you set aside a portion of your salary each month as your CPF savings. Both you and your employer pay a percentage of your wages to your CPF account, and the amount varies by age:

Before you turn 55 years old, your CPF consists of three different accounts, each with their own unique roles: the Ordinary Account (OA), Special Account (SA) and MediSave Account (MA). At 55 years old, your SA will be closed and a Retirement Account (RA) will be created for you.

It’s also worth noting that the interest rates you gain in these accounts are also different. For members below age 55, the OA has an interest rate of 2.5% per annum, while the RA (for members aged 55 and above), SA and MA interest rate is 4% per annum. In fact, you actually earn up to 5% on the first $60,000 of your combined CPF balances (capped at $20,000 for OA). Do keep in mind that these are based on the floor rate!

Meanwhile, for members aged 55 and above, while the rates on the individual accounts are the same, you instead get up to 6% on the first $30,000 of combined CPF balances (capped at $20,000 for OA).

This ‘extra interest’ of 1 – 2% aims to benefit all CPF members, especially members with lower balances.

Broadly speaking, there are three main uses for your CPF savings:

A common use for savings in your OA is to pay for your housing needs. This can include paying for the downpayment of a property, or servicing a housing loan. Buying a house is not only a big purchase, but also an important one that requires careful consideration. Using your OA savings can allow you to save more cash, thereby having more money on hand for immediate needs.

However, that’s not to say you should empty out your OA to buy your house! Remember that your CPF savings grow with compound interest, meaning they can grow more over time if you have a larger amount kept aside! Because of this, it’s recommended to pay for your housing purchase with a mix of OA savings and cash, so that you don’t overlook planning for retirement while buying your own home.

If you want to learn what more you can do to save money and make more prudent decisions for your home, here are some essential budgeting tips for your BTO you can take reference from!

Nobody likes falling sick, but at least you know that your CPF savings are helping you stay prepared if something unexpected happens.

Your MA savings can help cover your medical expenses, such as outpatient treatments and hospitalisation. You can also use your MA savings for long-term care and to pay premiums for insurance, such as MediShield Life and CareShield Life. It can also be used for your family members’ healthcare needs!

The maximum amount you can have in your MediSave is what is known as the Basic Healthcare Sum (BHS), which is the estimated amount of savings you need for basic subsidised healthcare expenses in old age. This amount is adjusted yearly until you reach the age of 65, when it will then remain fixed for the rest of your life.

Some examples of what you can use your MA savings for:

Outpatient treatments

These can include management of chronic diseases, vaccinations, health screenings and CT/MRI scans. You can find out more about using MediSave for outpatient treatments at this page.

Hospitalisation

You can use up to $550 per day for the first two days and $400 per day thereafter for inpatient hospital charges (including eligible Mobile Inpatient Care at Home stays). The charges covered include daily ward charges, daily treatment fees, investigations and medicines.

Do note that for this, you can use your own or approved family members’ MediSave, so you’re not limited to only your MA savings!

Find out more about the hospitalisation and surgery expenses that you can pay using MediSave.

Long-term care

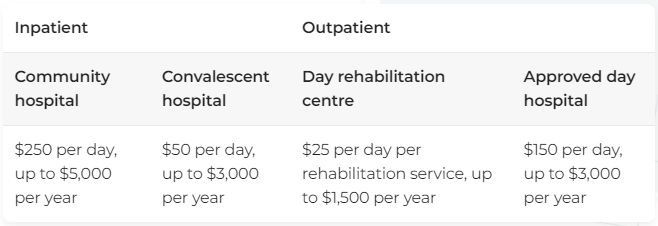

Your MA savings can also be used for rehabilitation and palliative care. The withdrawal limits are as follows:

Rehabilitation

Palliative care

- Inpatient palliative care in approved inpatient hospice palliative care services (IHPCS) - up to $250 per day for general palliative care and up to $350 per day for specialised palliative care

- Home palliative and day hospice care

- If you are terminally ill, there is no withdrawal limit if you are using your own MediSave to pay the bill, and you can also tap on your family member’s MediSave for payment up to a withdrawal limit of $2,500 per patient per lifetime

With MediSave’s key role of helping Singaporeans pay for their healthcare expenses especially in old age, it’s crucial to prevent premature depletion of savings. With this in mind, withdrawal limits are set to balance between helping Singaporeans afford the co-payment for their ongoing treatments, while ensuring they have sufficient savings for future healthcare needs.

Insurance premiums

You can also use your MA savings to pay for healthcare insurance premiums. These include premiums for MediShield Life, which covers large hospital bills and selected costly outpatient treatments, and Integrated Shield Plans (IPs).

An IP adds on to your existing MediShield Life coverage, including the cost of staying in private hospitals and Class B1 or A wards in public hospitals. If you’re considering buying an IP, here are some things to take note of before making a decision.

Similarly, CareShield Life premiums can also be paid with MA savings.

The core function of your CPF savings to help you prepare for retirement. This is done through CPF Lifelong Income For the Elderly (CPF LIFE), a national longevity insurance annuity which provides you with a flow of income through monthly payouts, for as long as you live!

Here’s how it works:

Before age 55, part of your CPF contributions go to your SA, which is primarily meant for retirement payouts. This is why unlike the OA and MA, SA has limited uses and is designed to help you grow your savings over time through compounding interest.

When you reach age 55, your RA is created. CPF savings in your SA (and OA too if required) will be set aside in your RA, up to your Full Retirement Sum (FRS). At this point, you will also be able to make a lump-sum withdrawal from your OA and SA* of at least $5,000, or any amount in excess of your FRS. Should you have immediate needs, this withdrawal can be done at any time from age 55.

Do note that withdrawals from your CPF savings will result in reduced payouts overall. If you do not plan to use your withdrawable savings, you can transfer them to your RA, up to the prevailing Enhanced Retirement Sum (ERS), to receive higher monthly payouts in retirement.

The amount in your RA will form your CPF LIFE premium, which you can start to drawdown on from age 65. If you choose to defer (up to 70), your payouts will increase by up to 7% for each year. This means that if you choose to defer until you’re 70, your payouts will increase by up to 35%!

Now that you know how the CPF system works, and understand the power of compounding interest, you can consider making a cash top-up to your CPF accounts, to help your CPF savings grow even more! Cash top-ups are also eligible for tax relief, and can help ease your financial burdens further! Try out the Retirement Payout Planner to see how you can plan for your retirement payouts and make the most of your CPF savings.

There are many considerations that come with planning for the future, and many competing needs to meet. While it may be difficult to prepare for all of them, your CPF savings serve as a starting point you can tap on to support your housing, healthcare and retirement needs! Proper understanding and utilisation of your CPF savings is the key to not only a happy retirement, but a smoother sail through the vagaries of life!

*From early 2025, the SA will be closed for members aged 55 and above.

The information provided in this article is accurate as of the date of publication.