CPF contributions for platform workers born on or after 1 January 1995

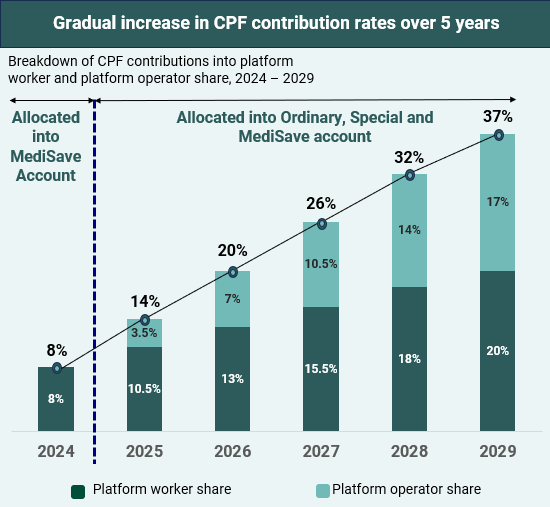

How will your CPF contribution grow to match that for employees?

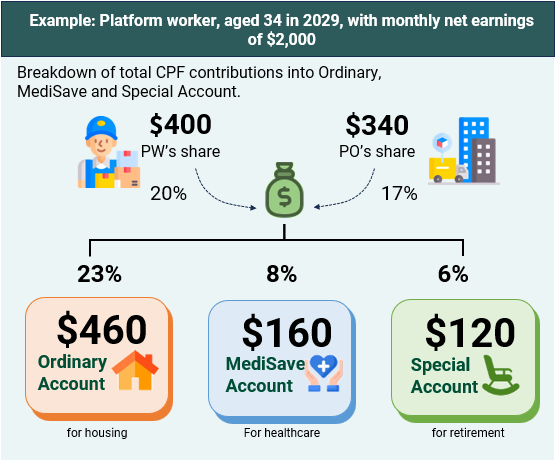

Your CPF contribution rates will gradually increase over 5 years to align with those of employees and employers, reaching up to 20% (your share) and 17% (your platform operator’s share) by 2029.

*Infographic shows CPF contribution rates for platform workers in the “35 & below” age group, with monthly net earnings above $750.

Through consistent contributions, your CPF savings will grow steadily, to support your housing, retirement, and healthcare needs.

How will your CPF contribution rate differ if you have net earnings below $750 a month?

Your CPF contribution rates will be lower if your net earnings are less than $750 a month: