Notice

Our CPF hotlines are temporarily unavailable due to technical difficulties related to Singtel. We apologise for any inconvenience caused. For urgent assistance, please reach us through our Text Us service, and we will respond as soon as we can.

Benefits

Peace of mind and a secure retirement

What to consider

How to get the payouts you want based on your desired retirement lifestyle

Inclusion

Will you be included?

Options

Comparing CPF LIFE Plans

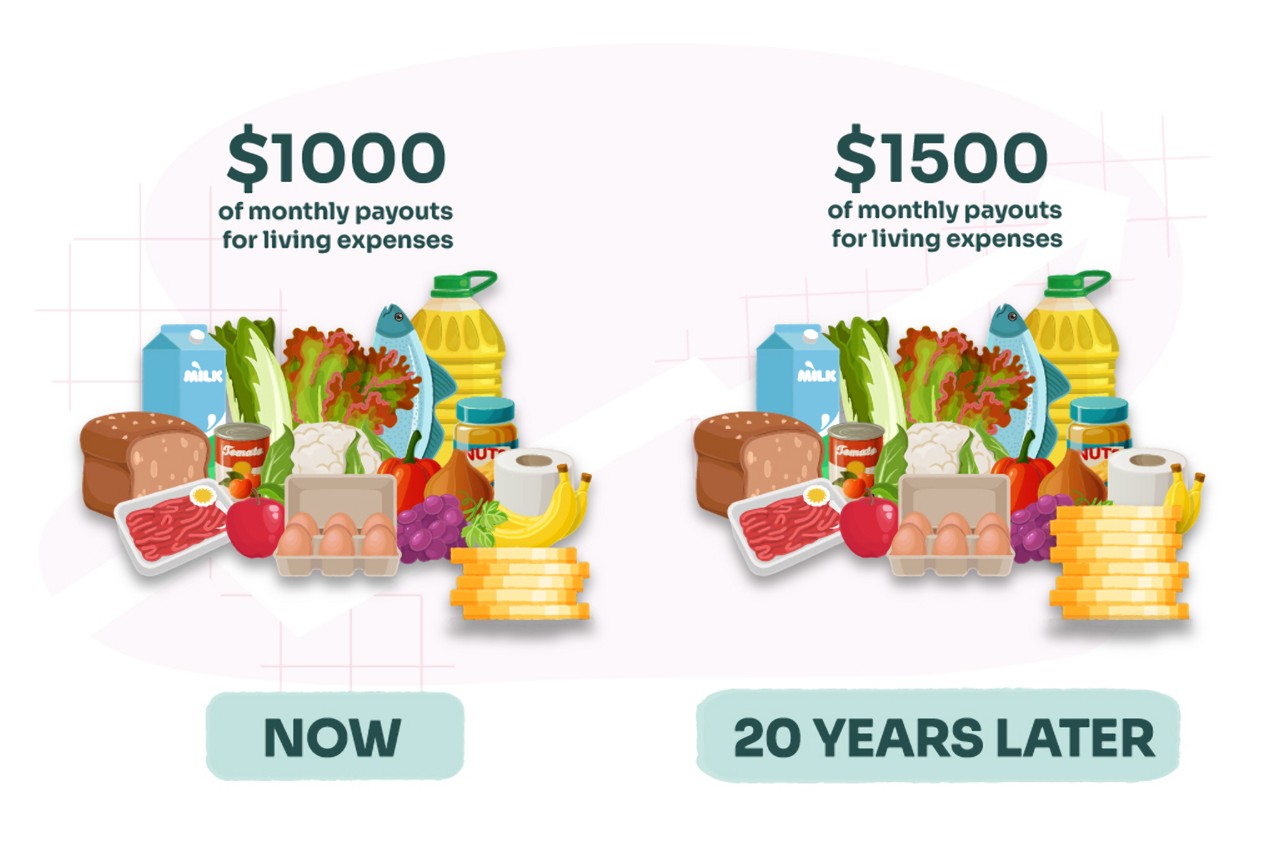

The CPF LIFE plan you choose depends on how willing you are to adjust your retirement lifestyle, as things become more expensive.

Ways to manage

How to manage your CPF LIFE

Managing payouts

Increasing payouts

Updating your preferences

Resources

Need more information?

Articles