17 Jul 2023

SOURCE: DollarsAndSense

This is the second of a three-part content series where we will focus on the CPF LIFE schemes, why CPF members decided on the CPF LIFE plans that they are on, and how they can be empowered with the knowledge to make informed decisions to live a fulfilling and secure retirement.

In the first article, we delved into the role played by the CPF LIFE Escalating Plan in safeguarding the lifestyles of Singaporean retirees amidst inflation as it provides a 2% increment in its annual payouts.

It is assumed that retirees will spend less during retirement because of a simpler lifestyle. For example, lesser work-related expenses – commuting, professional clothing, or eating out when they are working.

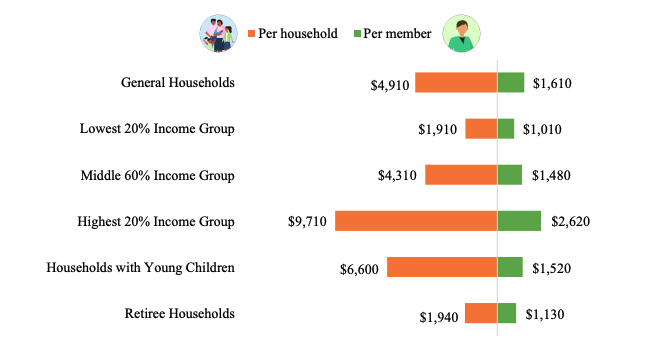

According to a July 2021 report by the Singapore Department of Statistics, this perception appears to be accurate. On average, retiree households (defined as households that comprise solely of non-employed persons age 65 and above – averaging to about 2 persons) spend an average of $1,940 per month.

In comparison, the same report shared that households with young children (defined as households with at least one child age below 16 years – averaging to about 4 persons) spend an average of $6,600 a month.

Table 1, Source: SingStat

In this sequel, we seek to unravel the intriguing question of whether retirees, in light of rising prices, find themselves constrained in their purchasing ability and are compelled to settle for a simpler lifestyle than they had before retiring.

Are they spending lesser today because they need to reduce their monthly expenses, or because they no longer have as much financial commitments as they used to (e.g. housing, paying for their kids’ education).

Here’s what two retirees shared with us.

Pamela (not her real name), now 66 years, shared that she retired four years ago. Previously, she was working at an architecture and property management company. She shared that since young, she has been actively managing her money and finds it useful to track her income and expenses regularly. She also took efforts to learn and to invest her savings during her working years.

This has paid off as she finds that today, she doesn’t have to worry too much about money. She receives dividend income from her investments, which include unit trusts, shares, and REITs. She also chose the CPF LIFE Standard Plan, which offers a level monthly payout. Even without her investment income today, Pamela finds that the CPF LIFE payouts alone are sufficient to cover her basic expenses each month.

For example, a 55-year-old female who set aside the Full Retirement Sum of $198,800 (as of 2023) at age 55 can expect to receive about $1,490 each month from the CPF LIFE Standard Plan from age 65. This is an amount that is higher than the average retiree spends each month ($1,130).

Table 2, Source: Monthly Payout Estimator

Pamela also shared that her basic expenses now are much lower today (about 50% lesser) as compared to her working years – she no longer incurs as many expenses as a caregiver to her parents. Expenses she could cut out includes not needing a car and no longer requiring a domestic worker.

Pamela recognises that health is very important, as poor health will not only affect the quality of her retirement but will be costly. She aims to keep herself active by volunteering at nursing home foundations where she can help others.

Pamela shared that one of the best parts of being a volunteer is that she gets to pick up new skills and attend free courses. She also gets to expand her social network. She shared, “You will think you’re helping others; (but) you’re actually helping yourself.”

An early retirement wasn’t the initial plan that Wayne (not his real name) (age 69) was thinking of when he left his job in the aviation industry 12 years ago at the age of 57.

An avid saver in his younger days, Wayne has investments and savings that he can rely on. He shared that he did not have to change his lifestyle even after he stopped working more than a decade ago.

He found that his expenses had reduced because his son had finished his studies and larger expenses such as home mortgage were cleared. Wayne shared that he is, “a very practical person and when I have spare money, I look at where I can best put it to good use.”

Wayne is aware that he can begin his CPF LIFE payouts at any time from 65, but he has not commenced his CPF LIFE payouts as he feels that he doesn’t need the money. By delaying the start of his CPF LIFE payouts, he can increase his monthly payouts by up to 7% for each year that he defers.

For example, assuming a 55-year-old male has set aside the Full Retirement Sum of $198,800 (as of 2023), this amount will grow to about $295,000 (with risk-free CPF interest rates of 6%* per annum) by the time that they are 65 years old under the CPF LIFE Standard Plan, he will receive a monthly payout of $1,600 a month from age 65 onwards.

*Based on the current 4% interest rate floor on Special/Retirement Account.

Table 3, Source: Monthly Payout Estimator

However, if he chooses to defer the start of his CPF LIFE payout till the age of 70, his Retirement Account savings will continue to grow to $365,000 with risk-free CPF interest rates of 6%* per annum. His monthly payout will therefore, increase to $2,150.

*Based on the current 4% interest rate floor on Special/Retirement Account.

Table 4, Source: Monthly Payout Estimator

Wayne also shared that his biggest concern today is his health. He has chronic illnesses such as high blood pressure and has been assessed as a prediabetic, it’s important for him to manage his health to keep these chronic conditions in check.

Wayne is part of the Merdeka Generation, which enables him to enjoy additional subsidies for check-ups and medications at polyclinics and other outpatient clinics. This helps him significantly reduce his long-term healthcare expenditure in managing these chronic illnesses. MediShield Life would also help cover his hospital bills and selected outpatient treatments, if he ever needs to seek for treatments at a hospital.

Wayne shared that he also keeps himself active by volunteering at multiple organisations.

One takeaway we had chatting with both Pamela and Wayne was that their monthly expenses naturally decreased over time as they aged, due to fewer financial commitments, since they no longer have dependents.

At the same time, through volunteering, both Pamela and Wayne found meaning in keeping themselves active without the need to spend on unnecessary entertainment. They also get to expand their social circle as they interact with others.

Additionally, they are assured by CPF LIFE, which provides them with a basic income through monthly payouts no matter how long they live. They do, however, recognise that rising prices would be a concern for financial commitments that remain in their old age, and that if they wish to maintain their quality of life long into retirement, they will need solutions to mitigate the impact of inflation over time.

It is therefore noteworthy that even though you might eventually have lesser financial commitments in old age, the price of those remaining commitments will continue to rise over time. Hence, to mitigate the cost of rising prices, the CPF LIFE Escalating Plan would be able to help with its increasing payouts of 2% a year, for life.

Both Pamela and Wayne have demonstrated that with early planning, we need not worry about money in the future.

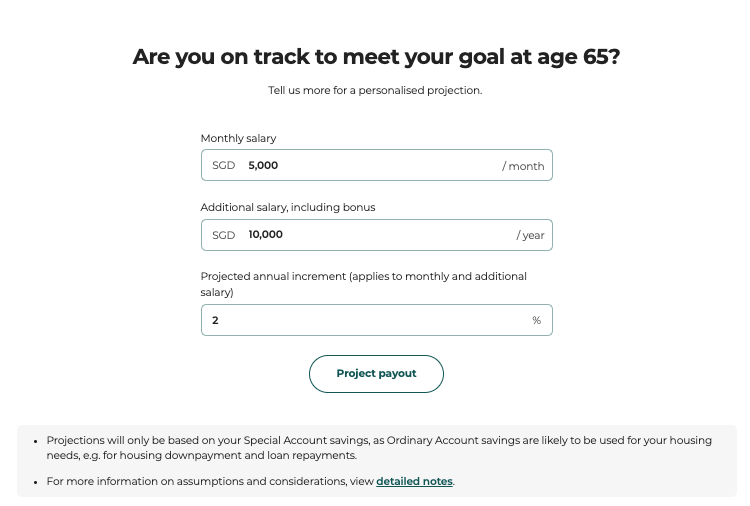

Even if you are 16 or even 53 years old (the ages that the CPF planner – retirement income is currently available to), you can start planning for your retirement income using the CPF planner. The results will be personalised to you, with inflation factored in.

For example, if you desire $2,500 a month as your retirement income goal based on today’s dollars at age 30, the CPF planner suggests that with inflation, you would need to work towards a payout goal of $4,530 (see table 5) at age 65. This is because things are likely to be more expensive in the year 2053 than they are today in 2023.

Table 5, Source: CPF planner

Next, by providing details like your salary and expected annual increment, you can view your projected retirement savings.

Table 6, Source: CPF planner

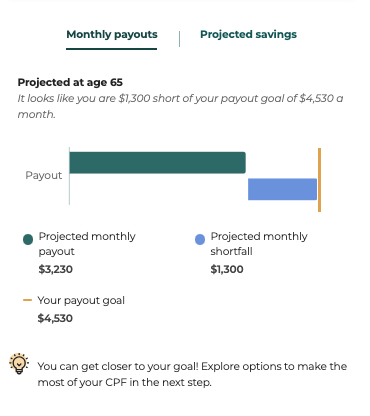

Towards the end of the CPF planner, it informs you of whether you’re on track to meeting your goal, and includes personalised suggestions on the steps you could take to get closer to your goals.

Table 7, Source: CPF planner

Lastly, you can simulate how you would like to work towards your goals, for example, by making a cash-top up or a CPF transfer. You can choose to simulate using a lump sum amount or break the amount down into regular monthly top-ups. What’s helpful is that you can also download the plan in a PDF file for future references and / or transactions you make.

Table 8, Source: CPF planner

While we initially thought money was going to be a main concern for retirees, we are wrong. In fact, we learn that good health is (and should be) the priority.

As what Pamela and Wayne have shared, taking ownership in keeping ourselves healthy is just as important as having good financial health. By planning to lead an active and healthy life, we can give ourselves the best chance of a fulfilling and longer healthspan. And that is something valuable that money can’t easily buy.

This article was written in collaboration with CPF. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here.

This article was first published on Dollars and Sense. Information in this article is accurate as of date of publication.