12 Aug 2022

SOURCE: CPF Board

Are you changing the way you shop for groceries nowadays? Is buying your favourite brands giving you cause for pause? Rising prices of everyday goods have been a cause of concern for many this past year, with overall inflation in June hitting 6.7 per cent year on year, the highest since September 2008.

What does this mean for the average consumer like you and me? Simply put, everything is getting more expensive. Prices are still expected to rise in the coming months due to external factors like pandemic-induced labour shortages, supply chain disruptions and global inflationary pressures.

While the current increase in prices might be triggered by one-off events such as the pandemic, the uncertainty of what will happen in the future and by extension what inflation will look like when you retire, is a huge factor in retirement planning. There is no ideal solution but as the saying goes, prepare for the worst, hope for the best. It’s not enough to just sit and hope that inflation rates are low. Instead, make plans now to fortify and build your future savings so that inflation will not erode the value of your future savings and purchasing power.

Here are two ways to maximise your savings.

1. Make the most of your CPF

Markets are unpredictable and may get volatile, but your CPF is a safety net that can help you guard against inflation. It is important to save (and boost) your money with CPF so that you have a solid foundation to guard against inflation.

Here are some ways to grow your retirement income through your CPF.

Make cash top-ups to your Special Account (SA) or Retirement Account (RA)

By making small, regular top-ups to your CPF accounts, your savings will grow steadily thanks to the power of compound interest.

Start early so that your money has a longer runway to accumulate interest.

And as a bonus, you’ll be able to enjoy tax relief of up to $8,000 per calendar year if you top up to your own SA/RA.

Note: CPF top-ups are irreversible

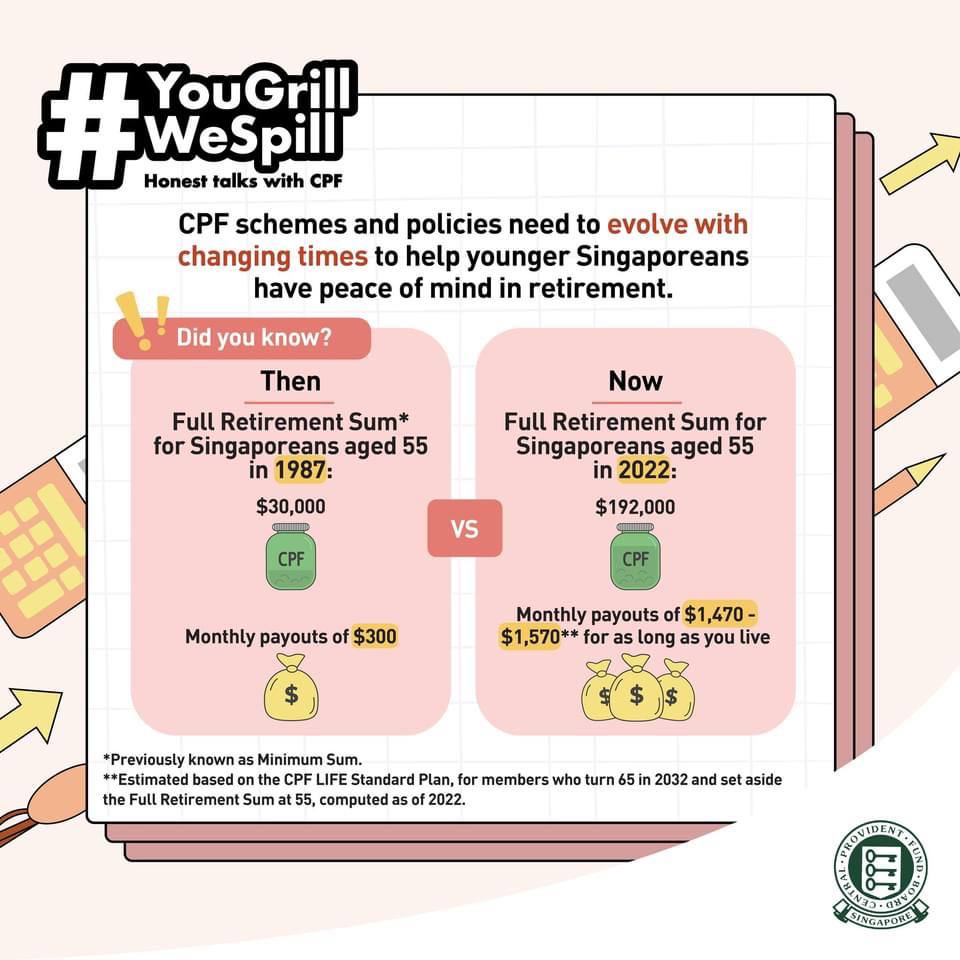

A common refrain about CPF is that the ‘goalposts’ are ever-shifting as the Retirement Sum keeps increasing. But have you ever thought about why that might be the case? To help you better deal with uncertainty in the future, we would need to ensure all our retirement income streams (including our CPF savings) are sufficient to meet our future needs amidst:

Inflation

Increasing standards/costs of living

Longer life expectancy

Consider waiting and letting your CPF savings grow

If you don’t have an urgent need for your CPF savings when you turn 55, one way of ensuring you have enough as you get older is to leave your CPF savings alone to continue growing your retirement nest egg instead of making a lump sum withdrawal.

While you can start your payouts at 65, it is not mandatory – you can actually choose to start any time between age 65 to 70. Consider giving your savings even more time to grow. For every year that you defer, your payouts will increase by up to 7%.

2. Tap on support from the Government

Pushing through inflation

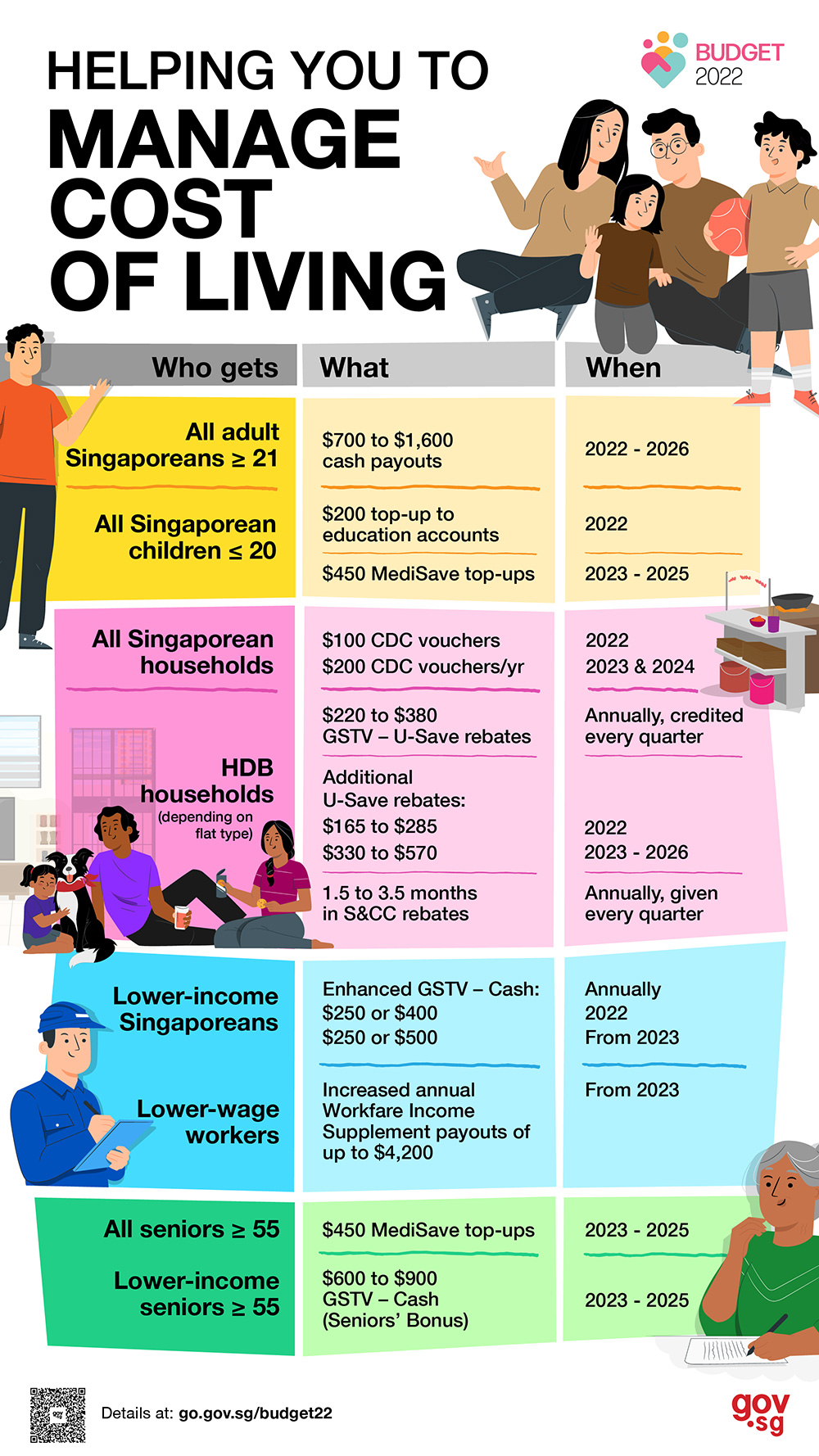

To help with the increasing cost of living, 1.5 million Singaporeans will receive up to $700 of GST Vouchers (GSTV) in cash in August 2022.

Eligible Singaporean HDB households will also receive additional rebates to offset their utilities and Service and Conservancy Charges (S&CC) bills.

Building up on MediSave savings

In July, Pioneer and Merdeka generation seniors received MediSave top-ups of between $200 and $900. Singaporeans aged 53 and above in 2022 who did not receive Pioneer and Merdeka generation benefits will receive a 5-Year MediSave Top-up of $100 in August.

Those aged 65 and above will also receive up to $450 of GSTV – MediSave in their CPF MediSave Account as well.

Lending a bigger helping hand

Singaporeans can also expect further support through the:

- $6.6B Assurance Package that was designed to help offset the rising costs of living and impending GST hike.

- $1.5B billion package that was recently announced in June 2022, to provide targeted help for the lower-income and vulnerable groups.

Learn more about how the Government is supporting Singaporeans as inflation impacts our daily lives.

Information in this image is accurate as at the date of publication.

Inflation might be out of our control, but we can still take control of our finances to ensure that we do not feel the full brunt of its effects in the future. Start planning early, so that your income can keep pace with inflation.

Whether there’s high or low inflation in the future, a strong financial plan will help you stay on track for your dream retirement.

Are you deflated by inflation? Here are some tips to help you cope with the rising cost of living.

Information in this article is accurate as at the date of publication.