14 Feb 2025

SOURCE: CPF Board

Everyone has their own vision of what their ideal retirement lifestyle looks like, and achieving this milestone in life can be a big motivator. Remember that your CPF savings serve as an important building block of your retirement income, and you can take proactive steps to grow the savings in your CPF accounts. Let’s take a look at four ways to do so.

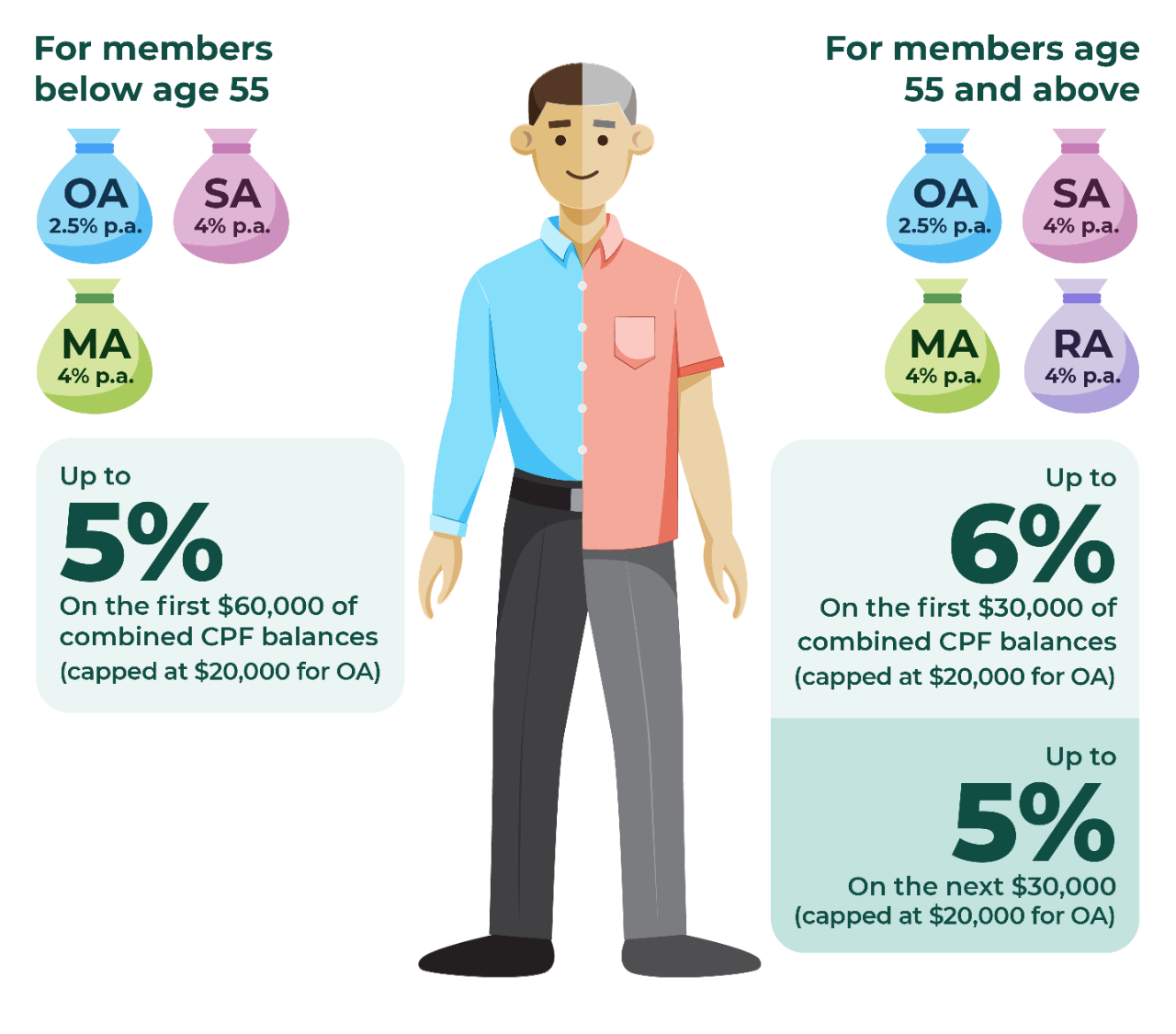

Topping up your CPF savings with cash does not mean you have to part with a large sum at one go. Making steady, regular top-ups is key to ensuring your CPF savings grow at a faster pace. Let’s take a look at the interest rates your CPF savings can earn:

Cash top-ups can take advantage of the steady interest rates offered by your CPF accounts to help your savings grow faster. In addition, to reap the full benefits of the interest rates, top up early in the year. To illustrate, you can earn 20% more interest on your CPF savings in ten years just by making top-ups annually in January instead of December.

You can also make it a habit to check your Yearly Statement of Account at the start of the year to get a clear idea of how much interest you have earned.

Your OA savings can be used for your housing needs, and you may prefer to keep your savings there to retain the flexibility to pay for home purchases. However, consider keeping at least $20,000 in your OA for future needs and for it to benefit from the extra 1% interest rate.

If you don’t intend to use your OA for housing, and want to maximise your returns, you can consider making a transfer from your OA to your SA, which enjoys a higher interest rate. For members aged 55 and above, transfers can be made to the Retirement Account (RA) which enjoys the same higher interest rate.

Either way, these CPF transfers are irreversible, so please be sure to review your plans before you make them!

Reaching 55 is a major milestone. One of the biggest things that come with this milestone is the ability to make a lump sum withdrawal from your CPF savings.

Do keep in mind that with the closure of the SA at age 55, your SA savings will be transferred to your RA, up to the FRS, with the remaining balances flowing to your OA. You can find out how much you are able to withdraw via your retirement dashboard.

While it can be tempting notion to have a large sum at your disposal, if you have no immediate need for the money, the better choice is to leave the savings in your CPF account so that they continue to grow with the steady CPF interest rates.

Here’s an illustration with some numbers to show how much more members would have gotten had they not made lump sum withdrawals in previous years. A member who started payouts at age 65 could have gotten $100 more in lifelong monthly payouts, if he had not opted to make a lump sum withdrawal. If the member opted to defer starting his payouts until age 70, this amount grows even bigger. It may not seem like a large sum, but it can add up to make a real difference, especially since you won’t know how long you will live.

Do note that the above image:

- Includes all members at age 65 in the respective years and assumes all members are on the CPF LIFE Standard Plan.

- Uses age 70 as the latest payout start age, to facilitate effective decumulation of CPF savings during member’s lifetime.

- Lump sum withdrawal before 65 refers to retirement withdrawals made from age 55 e.g., unconditional withdrawals of up to $5,000 or withdrawals in excess of the required retirement sums.

As alluded to above, you can also choose to defer your CPF LIFE monthly payouts up till age 70, especially if you are still employed or have other sources of income and have no immediate need for the payouts. This way, you’re giving your money more time to grow. The longer you leave the savings in your CPF accounts, the more time it has to benefit from the power of compound interest. Your payouts increase by up to 7% for each year of deferral. This works out to an increase of up to 35% if you choose to defer until age 70.

There’s no quick path to a happy retirement, steady steps are the only way to pave the path forward! Understanding your desired retirement lifestyle and the expenses that come with it are one part of retirement planning. Maximising the growth of your CPF savings to get more payouts in retirement is also very important! To reap the most benefit, start early, be it in your planning or actions, and make it a regular effort so that your savings and payouts can grow exponentially over time.

Information presented is accurate as of the date of publication.