18 Feb 2025

SOURCE: CPF Board

Launched in 2021, the Matched Retirement Savings Scheme (MRSS) has been helping senior Singapore Citizens with lower retirement savings save more, by matching the cash top-ups made to their Retirement Accounts (RA).

Previously, eligible seniors aged 55 to 70 received a dollar-to-dollar matching grant from the Government for cash top-ups received in their RA, of up to $600 per year.

These are the enhancements to MRSS from 1 January 2025:

Enhancements |

Previously (before 1 January 2025) |

Current (from 1 January 2025) |

Increase in matching grant cap |

$600 per year |

$2,000 per year, with a $20,000 cap over an eligible member’s lifetime |

Removal of age cap |

Age 55 to 70 |

Age 55 and above |

Eligible seniors can make more top ups to their RA and receive the higher matching grant amount.

Additionally, the removal of age cap means that more seniors will be eligible to enjoy the benefits of MRSS.

Your cash top-up and the matching grant in your RA will earn risk-free interest rates* of up to 6% per annum. This allows you to accumulate more savings, boosting your monthly payouts in retirement.

*Based on the current 4% interest rate floor on RA monies.

What about tax relief for MRSS?

From 1 January 2025, cash top-ups that attract the MRSS grant will not be eligible for tax relief.

You can continue to enjoy tax relief of up to $16,000 a year for cash top-ups that do not attract the MRSS matching grant ($8,000 per year for top-ups to yourself and another $8,000 per year for top-ups to your loved ones).

Who is eligible for MRSS?

You will be eligible for the MRSS if you are a Singapore Citizen and meet the following criteria:

Age+ |

Age 55 and above |

Retirement Account (RA) Savings* |

Less than $106,500^ |

Average Monthly Income |

Not more than $4,000 |

Annual Value of Residence |

Not more than $21,000 |

Property Ownership |

Own not more than one property |

+As of 31st December of the assessment year

*RA savings refer to the cash set aside in the RA (excluding amounts such as interest earned, any governments grants received), plus retirement withdrawals. If you are turning 55 in the assessment year and your RA has not been created at the time we assess your eligibility, your total Special Account and Ordinary Account savings will be assessed instead.

^Current Basic Retirement Sum for 2025.

Your eligibility is automatically assessed every year. CPF Board will notify you at the beginning of each year if you qualify. You can also check your eligibility for the MRSS anytime via your Retirement dashboard (Singpass login required).

Why should you make cash top-ups?

Having adequate retirement savings can provide peace of mind and financial security in your golden years. The more you save now, the less you’ll need to rely on others during retirement.

At the end of each year, the total amount of cash top-ups will be computed, and the matching grant will be credited by the first quarter of the following year.

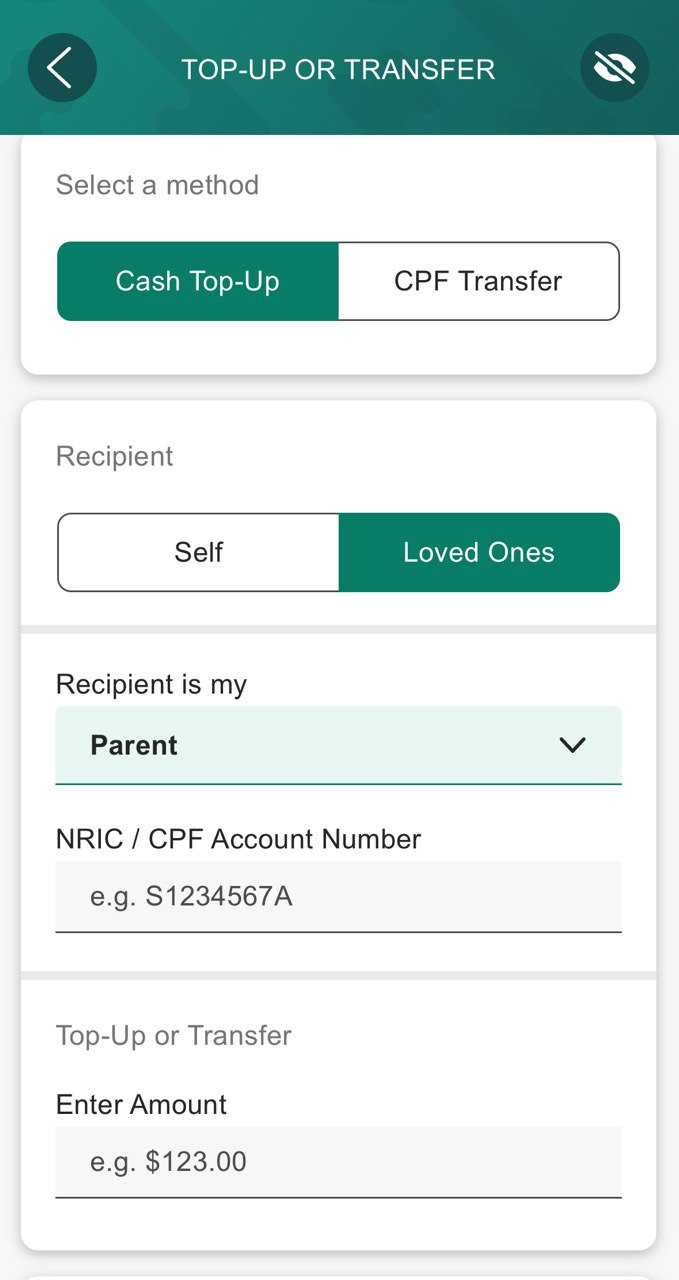

Make a top-up for your loved ones

If you feel that your loved ones could do with a boost to their retirement savings or if their current savings are insufficient, the MRSS grant offers a simple solution to help them save more for retirement. It gives their savings a quick and easy boost!

Make a cash top-up early and enjoy the power of compound interest from the stable interest rates – even a small top-up will grow significantly over time. This small gesture will contribute towards giving your loved one (and yourself) better peace of mind.

How to make a top-up

You can make a top-up easily via the CPF website or CPF Mobile.

Top up via the CPF website

Top up to your loved ones via CPF Mobile

Check out other ways to top up.

Take a step today towards boosting your finances for tomorrow! Make a CPF cash top-up to your RA, leverage the MRSS grant, and grow your CPF savings for yourself or your loved ones. Remember, a small step now can lead to a big leap towards growing your retirement income.

Information in this article is accurate as at the date of publication.