20 Sep 2022

SOURCE: CPF Board

As you move gradually towards your golden years, perhaps you might be making lifestyle changes and finding a new home that is more suitable for your retirement plans. If that’s the case, why not consider ‘right-sizing’ your current home?

A key benefit of right-sizing, such as moving to a smaller house, is that it could potentially give your retirement income a boost. On top of any possible proceeds from selling your current place, moving to a smaller home might also mean saving on utility bills.

However, right-sizing your home is not just about money. While financial considerations are, and should definitely be, at the top of your list, there are a myriad of factors that you have to think about before making a final decision.

For example, living in a bigger space as you age will be progressively more difficult to maintain. Upkeeping and maintenance will also incur additional costs, not to mention the physical toil.

If your children have already moved out, having a big empty space might also heighten the feeling of loneliness. An option is to right-size and move closer to your family. Alternatively, you could also consider moving closer to your friends and/or communities with people of similar age groups, interests, and hobbies.

Here are some housing options for seniors if you are looking to right-size your home.

1. Community Care Apartments (CCA)

This is a joint offering by the Ministry of National Development (MND), Ministry of Health (MOH) and Housing & Development Board (HDB) to provide seniors with more independent housing options within the community. Singaporeans aged 65 years and above have the option of living in homes that integrate senior-friendly features with care and support services.

The pilot project at Bukit Batok launched in Feb 2021 saw high demand, with 91% of the 169 flats offered being taken up. There are plans to launch a second project at Queenstown later in 2022.

Features

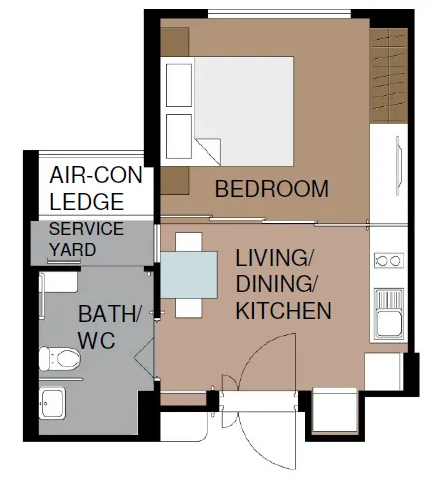

Image source: HDB

Each unit has an internal floor area of 32 square metres, and comes fully furnished and fitted with elderly-friendly features including:

Wide and wheelchair-friendly main door with a built-in bench at the side

Wheel-chair accessible bathroom fitted with grab bars and slip-resistant flooring

Built-in wardrobe and cabinets

Furnished kitchen (appliances are not provided)

Easy-to-slide partitions between rooms for privacy

Each block will also have communal spaces on every floor to allow residents to connect with their neighbours and participate in group activities.

All residents will have to subscribe to the Basic Service Package, which includes care and support services, basic health checks and 24-hour emergency response. Care services such as social day care, housekeeping and meal services can be further included at an additional cost.

Eligibility conditions

You must be a Singapore Citizen to apply. If you are applying with your spouse, or parent(s)/child(ren), at least one of them must be a citizen or Singapore Permanent Resident. All buyers and their spouses must be at least 65 years old at the time of application.

Learn more about the eligibility conditions for the Community Care Apartments

2. Short-lease 2-room Flexi flats

If you are 55 years old and above, you can also consider buying a 2-room Flexi flat from HDB, which gives you the flexibility to choose the duration of your lease. You can decide on a lease of between 15 and 45 years in 5-year increments, as long as it covers the youngest owner up to at least age 95.

If you wish to buy a 2-room Flexi flat to live close (i.e., within 4km) to your married child, you can enjoy priority under the Senior Priority Scheme (SPS) ,which improves your chances of being balloted for a flat.

Features

There are two sizes for the 2-room Flexi-flats: 36 square metres and 46 square metres.

These senior-friendly short-lease flats come installed with grab bars. You can also opt for additional senior-friendly fittings in the flat. These include built-in kitchen cabinets with induction hobs and cooker hood, kitchen sink, and a built-in wardrobe.

Most of the 2-room Flexi flats are within larger developments which are home to residents of all ages. There are also no compulsory service packages.

Eligibility conditions

Similar to the Community Care Apartments, you must be a Singapore Citizen to apply. If you are applying with your spouse, or parent(s)/child(ren), at least one of them must be a citizen or Singapore Permanent Resident. All buyers and their spouses must be at least 55 years old at the time of application.

Note: You are not eligible to buy a short lease 2-room Flexi Flat or Community Care Apartment if you had previously bought 2 or more subsidised housing units, one of which was a Studio Apartment or a short lease 2-room Flexi flat or Community Care Apartment.

3. Resale flats

Alternatively, you have your pick from the wide range of flats on the open market. Resale flats come in various sizes, age and locations, which in turn influence their prices. Remember to consider your budget and needs before deciding on a flat, as well as factor in renovation costs (which may depend on the condition of the flat).

So many options - which one to choose?

It really depends on your preferences, needs and financial considerations as you progress to the next stage in your life.

If you value companionship from your peers as well as senior-friendly care services, then the Community Care Apartments are for you. Otherwise, you can consider short-lease 2-room Flexi-flats, especially if you have children and wish to stay close to them, which are more readily available in different locations. Finally, if you want the widest range of options in terms of flat sizes and locations, you can look for resale flats on the open market to find a flat that fits your budget and needs.

Of course, you can also choose to continue living in your current home if it suits your retirement needs too! You can also enquire your eligible Housing Monetisation options through HDB's e-service.

No matter your choice, it’s important to make sure you exercise financial prudence when you make the next move. Always make the right plan with both your housing and retirement needs in mind.

Information in this article is accurate as at the date of publication.