22 Mar 2024

SOURCE: CPF Board

Following the Budget Announcements for 2024, it’s once again time to look at the changes that are coming your way. As CPF serves as the foundation for Singaporeans’ basic retirement needs, these enhancements ensure that CPF continues to help Singaporeans achieve retirement adequacy.

Here are what the changes to CPF in 2024 mean for you:

Strengthening Retirement Adequacy of Seniors

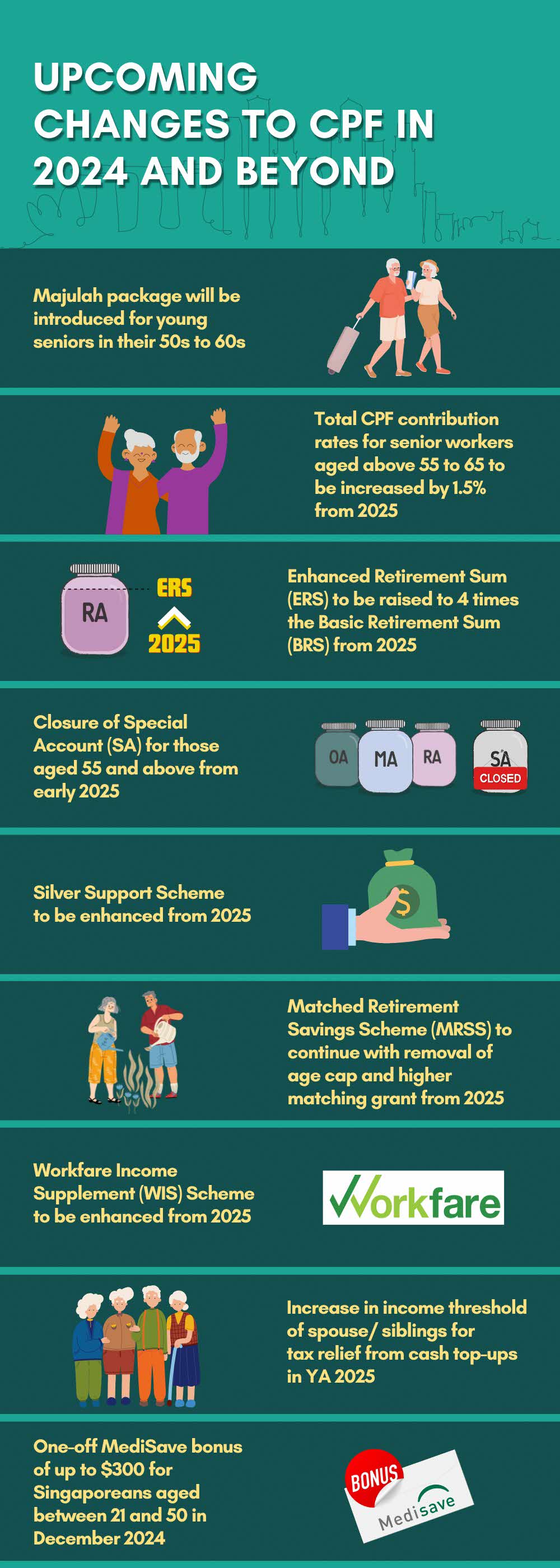

1) Majulah package to be introduced for “young” seniors in their 50s to 60s

The Majulah Package will be rolled out to support “young seniors”, who are in their 50s and early 60s. Members in this group have faced unique challenges, including having had a shorter runway in their life to benefit from recent improvements to the CPF system, and having to care for both the young and old in their families. This package, which is intended to help them better prepare for retirement, will also be extended to Pioneer and Merdeka Generation seniors.

2) Total CPF Contribution rate for senior workers to be increased by 1.5% in 2025

For senior workers aged above 55 to 65, the total CPF contribution rates will be increased by 1.5% from 1 January 2025, inclusive of a 0.5% increase from the employer’s side, and 1% from the employee’s side. Contribution rates for employees aged 65 to 70 remain unchanged, at 16.5% of their wage.

Below is a table of the upcoming changes:

In addition, CPF Transition Offset (CTO) to employers will be provided for another year. The CPF Transition Offset (CTO) is a transitionary wage offset meant to alleviate the rise in business costs due to the increase in CPF contribution rates for senior workers. It is equivalent to 50% of each year's increase in employer CPF contribution rates for every Singaporean and Permanent Resident worker they employ aged above 55 to 70. The offset to employers will be based on employees’ monthly incomes paid up to the CPF salary ceiling. This will support employers by covering half of the 2025 increase in employer contributions.

3) Enhanced Retirement Sum to be raised to four times the Basic Retirement Sum (BRS) in 2025

The retirement sum provides a reference point on how much you need in your CPF savings to achieve the level of your desired monthly payouts for your retirement expenses. The Enhanced Retirement Sum (ERS) is the level where there are higher monthly payouts, which makes it suitable for those who might require more retirement income. It is set as a multiple of the Basic Retirement Sum (BRS), which is the level that provides monthly payouts to cover basic living needs, excluding rental expenses.

Currently, the ERS is set at three times the BRS. From 1 January 2025, it will be raised to four times the BRS, allowing members to set aside more in their CPF to receive even higher monthly payouts.

Aligning CPF interest rates to the nature of CPF savings

4) Closure of the Special Account (SA) for members aged 55 and above

The Special Account (SA) for all members aged 55 and above will be closed from early 2025. SA savings which contribute to members’ retirement payouts and cannot be withdrawn in a lump sum will be transferred to the Retirement Account (RA), up to the Full Retirement Sum, where they will continue to earn long-term interest rate.

The remaining SA savings that are withdrawable on demand will be transferred to the Ordinary Account (OA) and earn the short-term interest rate. The change is intended to better align CPF interest rates to the nature of CPF savings. In early 2025, members will be notified after the transfer of all their SA savings to their RA and/or OA, and closure of their SA. They will also be able to check the amounts transferred from their CPF statement.

Members are not required to take any action for now.

Enhancements to Support Schemes for lower-income workers

5) Silver Support Scheme qualifying per capital household income to be raised

The Silver Support (SS) Scheme provides continuing financial support for Singapore Citizens aged 65 and above, who had low incomes during their working years and now have less in retirement. From 2025, the SS Scheme quarterly payments will be increased by 20% to strengthen support for eligible senior Singaporeans who have less in retirement. The qualifying per capita household income threshold will also be raised from $1,800 to $2,300.

1 Self-employed persons should also have an average annual net trade income of not more than $27,600 when they were aged 45 to 54.

2 Senior should not own, and not have a spouse who owns, a 5-room or larger HDB flat or private property or multiple properties.

3 Senior may live in, but do not own, a 5-room HDB flat.

6) Matched Retirement Savings Scheme (MRSS) to continue with removal of age cap and higher matching grant

The Matched Retirement Savings Scheme (MRSS) is a scheme that helps senior Singapore Citizens with lower retirement savings build up more savings for their retirement, by matching dollar for dollar to the cash top-ups made to their Retirement Accounts (RA). It will continue beyond its pilot with the following enhancements:

Tax relief for cash top-ups that attract the MRSS matching grant will be removed as the matching grant is already a significant benefit extended by the Government. Givers can continue to receive up to $16,000 in tax relief on cash top-ups that do not receive the matching grant.

7) Workfare Income Supplement (WIS) Scheme enhancements

Introduced in 2007, the Workfare Income Supplement (WIS) Scheme is a broad-based measure that tops up the salaries of lower-income workers to help them save for retirement, and encourages eligible workers to work and build up their CPF savings.

From 2025, the qualifying income cap for the Workfare Income Supplement Scheme (WIS) will be increased from $2,500 to $3,000 to ensure that lower-income workers continue to be covered, even as wages grow. Workfare payments will also be increased, with the maximum annual payment increased from $4,200 to $4,900.

The maximum workfare annual payment for varying ages are as follows:

Other changes and government support for Singaporeans

8) Increase in income threshold of spouse/siblings for tax relief from cash top-ups

The income threshold to qualify for tax relief for cash top-ups made to spouse/siblings will be increased from $4,000 to $8,000, for top-ups made from 1 January 2024 in Year of Assessment (YA) 2025.

9) One-off MediSave bonus of up to $300 for Singaporeans aged 21-50

All adult Singaporeans aged 21 to 50 will receive a one-time MediSave Bonus of up to $300, which will be paid in December 2024. The amounts that will be paid are as follows:

The changes to the CPF system are intended to help all members, regardless of which stage of life you are at. This includes providing more support for members who might be facing challenges in building their retirement nest egg, as well as strengthening support for seniors approaching retirement and may need more help. By changing alongside the times, it becomes easier to maintain a sense of security amidst shifting concerns and needs.

Information in this article is accurate as at the date of publication.

.jpg)