22 Nov 2024

SOURCE: CPF Board

What’s meant to be will always find its way.

John believed that everything happened simply because it was meant to be. But what happens when life takes an unexpected turn? This is a true story of a series of unfortunate events that struck John and his family in a span of just six months.

Have you heard of this website?

John was anxious as he explained his situation. His father had invested a significant portion of his savings into an investment opportunity offered by a friend he had met online. Both his money and supposed profits were now inaccessible due to supposed technical difficulties.

It was also the first time he heard about the investment from his father.

A quick check of the website revealed that the domain had been registered just two months ago. It was enough to set off the alarm bells, and soon became clear that his father had fallen victim to a scam. They subsequently made a police report, but unfortunately, the "friend" had disappeared. The sobering reality soon set in - he had lost all his money.

But John and his family had no idea that this was only the beginning of their troubles.

Not long after, John’s father, Gordon, who had just turned 60, was dealt another blow. The company where he had worked for nearly 20 years decided to let him go. As the family’s sole breadwinner, the retrenchment was devastating, especially as he was still trying to recover from the loss. John had only recently graduated, and his younger sister had just started university. Money was tight, and the family’s future felt increasingly uncertain.

And then things took another turn. Having been without a job for months, Gordon began to feel (and look) unwell, losing a lot of weight. But he wouldn’t see a doctor, possibly to avoid worrying his family further, or simply out of stubbornness.

But as Gordon’s symptoms worsened — constant thirst, vomiting, fatigue — it became clear he needed medical attention. John intervened and brought his father to the Accident & Emergency department at Tan Tock Seng Hospital. It didn’t take the doctors long to identify that he had diabetic ketoacidosis, a life-threatening condition that required immediate treatment. It could have been fatal had he even waited one more day.

Some things are unpredictable and may seem like it’s meant to be, but that doesn’t mean we can’t prepare. Building up a financial safety net can help protect your family in challenging times. Talking about money and the future with your parents, can be tricky, but it’s important to get these essential conversations started. Here are three tips to help you begin.

It starts with a dream. Ask your parents how they picture their retirement. Do they want to travel the world, pursue a long-time dream, or even continue working? Think about different scenarios, for example – if they were unexpectedly retrenched, would they prefer to find another, possibly lower paying job, or occupy their time with volunteering or taking care of the grandkids? It can be an illuminating exercise, and once their vision is in place, discuss how they can make it a reality.

Prompt them to review their CPF savings, which can provide the financial foundation to achieve those goals. From age 65, CPF LIFE provides your parents (and the future you) with payouts for life, no matter how long they live. Take some time to help them explore which CPF LIFE plan option best fits their aspirations in retirement.

You can further supplement that talk with action. Consider making cash top-ups to your parents’ CPF accounts. The CPF top-ups for your parents can earn an interest rate of up to 6% per annum1, giving their retirement nest egg a further boost.

Plus, there is also the added bonus of getting tax relief of up to $8,0002 per calendar year if you make CPF top-ups to your parents. This can total up to $16,000 of tax relief2 per calendar year if you also make CPF top-ups to yourself.

If they are eligible for the Matched Retirement Savings Scheme - the Government will match dollar for dollar any cash top-up to their Retirement Account (RA) - up to $2,000 per year, with a $20,000 cap over their lifetime starting from 1 January 2025. Cash top-ups that enjoy this Government matching grant will not be eligible for tax relief.

1Based on the current 4% interest rate floor on Retirement Account monies.

2Terms and conditions apply.

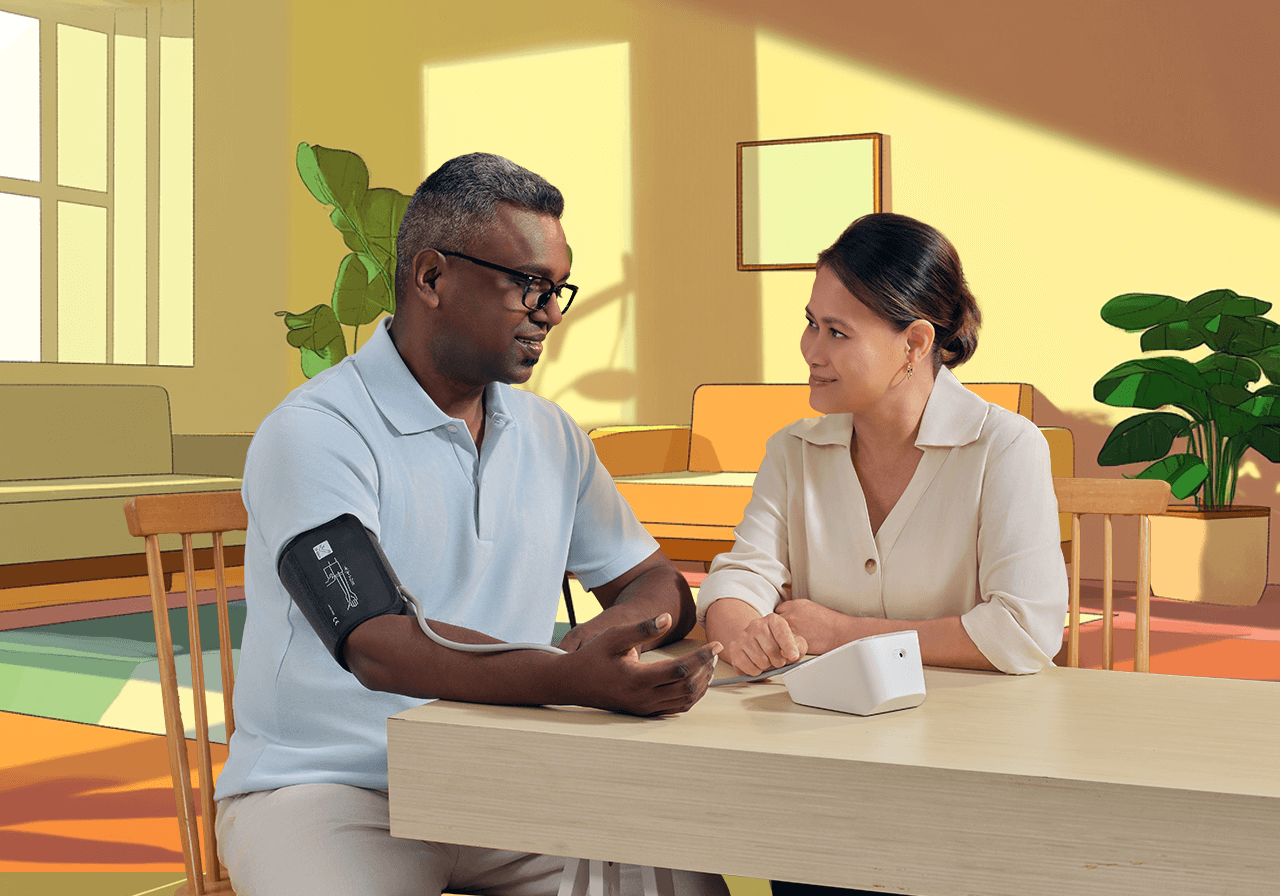

Part of the discussion on the quality of their retirement should also include their health. While these conversations can be sensitive — especially if your parents tend to brush off concerns — it’s better to adopt a ‘no regrets’ mindset and be proactive, even if their initial response is lukewarm. Encourage regular health screenings and, if possible, do it together with them and make it a yearly routine.

An important factor to consider is also the long-term affordability of healthcare. If they have an Integrated Shield Plan (IP), review it together to ensure it aligns with their long-term needs and budget, as premiums will increase exponentially with age. All Singaporeans are covered under MediShield Life, a basic national healthcare insurance plan that can help cover large bills in Class C/B2 wards in public hospitals and selected outpatient treatment. You can use your MediSave to pay for MediShield Life premiums, on top of a range of medical expenses for both yourself and your loved ones.

As they make the transition towards retirement, it’s essential that they keep their minds healthy and active as well. You can support them to try new experiences, develop new skills or simply connect with communities of like-minded people. This will keep them physically active, mentally stimulated and socially engaged.

Learn how your parents can age actively to enjoy their golden years.

As your parents approach their golden years, managing their CPF becomes increasingly important, with several key decisions to make. The CPF website provides a convenient way to do so, offering personalised dashboards for retirement, homeownership, healthcare, and more. It also links to relevant digital services to assist with planning and decision-making.

You can also guide them to use CPF Mobile - which allows easy access anytime, anywhere. They can quickly view their CPF statement, access services like making a CPF nomination, and receive push notifications for updates, scam alerts, and personalised CPF matters.

A year on from the scam, John and his family are in a much better place. Gordon is successfully getting his diabetes under control, and has just secured a new job.

Through it all, John has become appreciative of life’s small blessings. He is especially grateful that despite the uncertainty, they at least had a roof over their heads and stuck together to overcome the challenges. This entire experience has underscored the value of financial security and the importance of planning ahead for life’s uncertainties.

What’s meant to be will find its way when you’re better prepared for it. It may be “meant to be”— but your actions today will go a long way towards shaping a better tomorrow.

Information in this article is accurate as at the date of publication.