22 January 2024

SOURCE: Heartland Boy

6 years ago, I wrote a pensive blog post on what shaped my values on personal finance which revealed the divergent values towards money that my parents hold. Growing up, I was determined to take charge of my own financial future once I started earning my first pay cheque. As such, I began to take a keen interest in retirement planning and would attend free seminars during my free time. Friends often asked what inspired me to start my retirement planning at a super young age of 25 and I would respond that I attribute this realisation to a specific incident during my adolescence.

I vividly recall an episode when my mum assigned me the task of running an errand in the neighbourhood – to update her bank book. She would have an annual routine of checking her bank balances as Internet banking wasn't as widespread during that time.

When my mum presented the bank book, she informed that these were what she had set aside for her retirement. As I opened the bank book in expectation of a substantial amount, I was in for a rude shock to discover that it was less than $20,000. With the addition of the few thousand dollars in her CPF accounts at that time, I knew her retirement nest egg could not realistically last. She was also fast approaching age 50 which then gave her a shorter runway to build up her nest egg.

My hawker parents dedicated their entire working lives worrying about putting food on the table and ensuring their children received an education. Meeting these basic needs took priority and the idea of contemplating their own retirement was considered a luxury. As a result, retirement planning for them had clearly been put on the backburner.

Photo: Heartland Boy’s parents in front of their hawker stall back in Year 2014

In the journey of understanding and managing my finances, I’ve come to realise the profound impact of familial experiences on financial habits. Growing up in a household where financial struggles were a daily reality; it became clear that financial literacy was not just a personal responsibility but a shared commitment. Here are the steps that I took and now regularly revisit on an annual basis:

It dawned upon me that that the sacrifices my parents made provided me with a solid foundation and an opportunity to start planning my financial future earlier than they did. This was something that they never had as young adults. It’s a golden opportunity that I won’t let slip by as I am determined not to disappoint my parents. Even though it is not explicitly expressed, I understand that they hope for me to achieve better financial success compared to them. After all, I’ve received a tertiary education, while my mum never had the chance to attend primary school.

I envisage my retirement to be built on a secure financial foundation, with the freedom to make decisions without worrying too much about finances or the lack thereof. Establishing this awareness marks a positive beginning; the next step involves scrutinising my financial circumstances and evaluating each financial decision, recognising that priorities may evolve with the passage of time.

Back in 2021, I did an exercise to find out what is the amount my household of 3 requires to achieve financial freedom. That exercise stated the end goal was an estimated $2.5mil— for financial freedom, not retirement. Financial freedom to me means having enough to cover my living expenses and pursue the lifestyle that I want, without being tied to a traditional job. For retirement, it refers to a phase in life when one stops regular employment which is usually after the age of 60. My perspective on retirement is that I should be able to enjoy the finer things in life when I enter that phase of my life. This includes being able to afford more overseas trips and doing things that I enjoy such as sports.

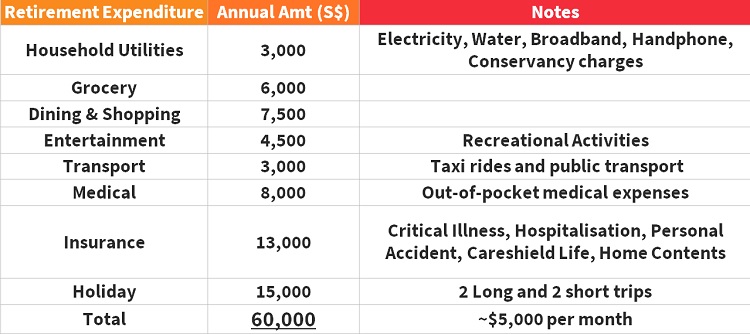

Assuming that I was to retire in 2024, after listing my needs and wants, I arrived at an estimated retirement expenditure for myself.

Diagram 1: Heartland Boy’s estimated retirement expenditure in 2024

The annual amount is approximately $60,000 in today’s context and works out to $5,000 per month. If I remove holidays and entertainment expenses, the amount is reduced to $3,375 per month. If I include my spouse’s retirement expenditure, the total amount should be lesser than double as we will enjoy some economies of scale from grocery shopping and household utilities.

To find out how far away I was from my financial goal, I started to pay attention to monthly expenses and savings. To work towards having a sufficient retirement fund, I resolved to set aside 30% of my monthly income as savings. This figure increases on months when I receive my performance bonuses. These days, I find tracking my savings has become more convenient as I can simply check SGFinDex.

Once the monitoring is done over a period of time, a pattern gradually emerges. As I reflect on my financial behaviour over a period of 10 years and life changes such as marriage and having children, I have cultivated a heightened awareness of my financial choices. This self-awareness has been instrumental in crafting a tailored retirement plan that aligns with my individual goals and aspirations.

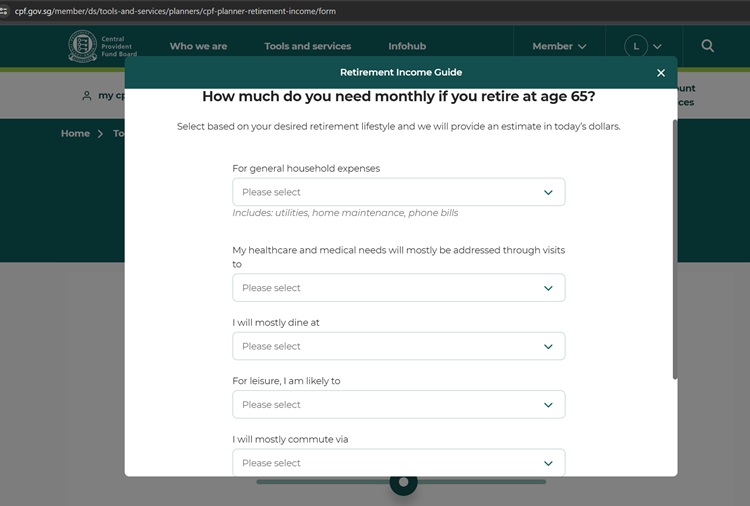

An excellent tool to get started on your personalised retirement plan is the CPF planner-retirement income. It allows you to project your Central Provident Fund (CPF) payouts and helps you plan for a retirement that meets your needs.

Diagram 2: CPF planner -retirement income on CPF website

To begin, I key in $3,375 per month. As aforementioned, this accounts for the essential spending during my retirement. I chose this for a start because I want to work towards a smaller financial goal first. I can re-evaluate it again when there are significant changes in my life such as birth of another child etc. If you are unsure of the amount you require, the retirement income guide shown in Diagram 3 will be a useful resource.

Diagram 3: Retirement income guide on CPF planner

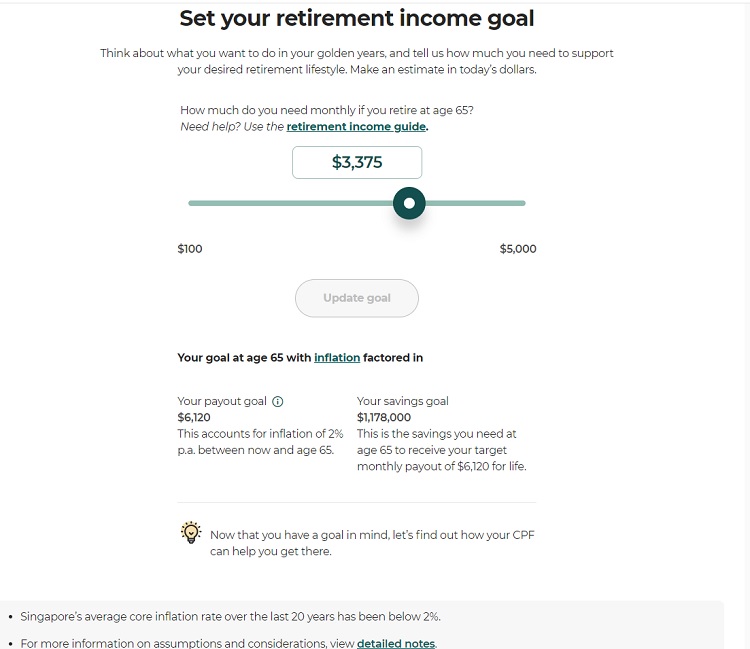

After factoring in inflation, $3,375 in today’s dollars works out to $6,120 per month when I turn age 65 as shown in Diagram 4.

Diagram 4: Heartland Boy’s retirement income goal at age 65

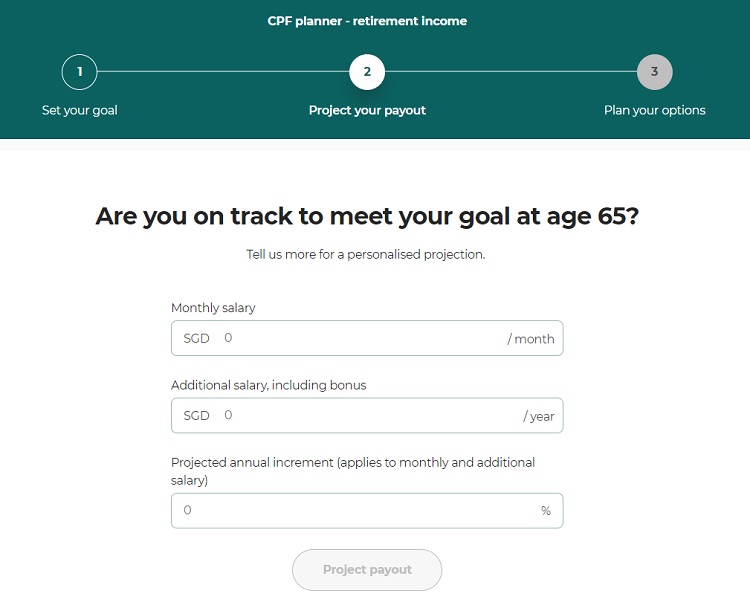

Next, I key in my wages, bonuses and annual increment as the next inputs.

Diagram 5: Screenshot of the stage of ‘projecting your payout’

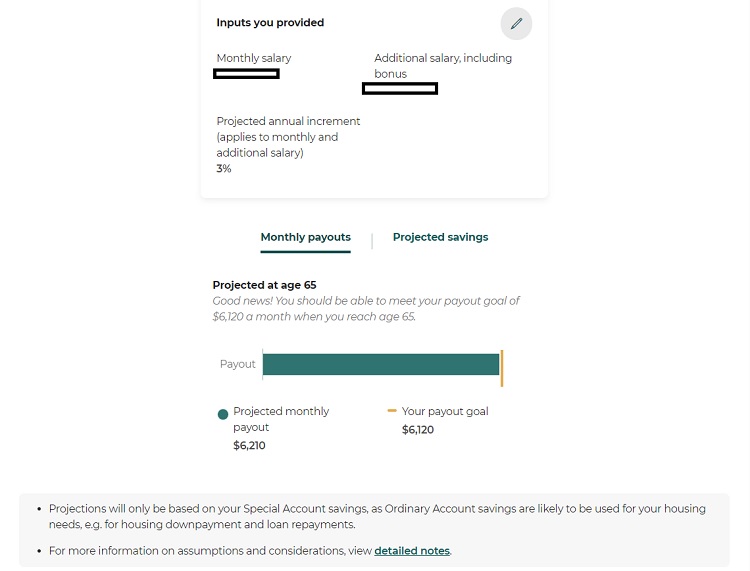

Subsequently, CPF planner generates my projected monthly payouts and savings that I would achieve by age 65 with these assumptions.

Diagram 6: Projected monthly payouts and savings from CPF planner- retirement income

Based on these inputs, CPF planner – retirement income states that I would receive a projected monthly payout of $6,210. I recall that the maximum amount that can be placed with CPF LIFE is the Enhanced Retirement Sum (ERS) and the projected payout exceeds the ERS at first glance. I investigated further and realised that CPF planner assumes that the “full savings can be committed to CPF LIFE”. While this does not replicate the real-life scenario today, where only the Enhanced Retirement Sum (ERS) can be committed to CPF LIFE, I understand that this is to accommodate future increases to the ERS. Furthermore, I know that I will still be able to withdraw the excess of Full Retirement Sum (FRS) from my Special Account (SA).

At the next step, CPF members with an estimated shortfall from projected payouts to meet desired retirement expense will have suggested options from the CPF planner and can simulate either doing a one-time CPF Transfer or making cash top-ups.

At the end of the exercise, I am relieved to learn that if I continue on the current trajectory, I will be able to meet my basic retirement expenses of $3,375 per month.

As early as 10 years ago when I was 25, I made a commitment to make the most of CPF as it is the most stable instrument to rely on during retirement. Therefore, I sought to accumulate the FRS in my SA as quickly as possible. Some conscious actions that I took included:

- Transferred CPF funds from my Ordinary Account (OA) to SA after housing downpayment was made

- Used cash to top up to my MediSave Account (MA) to achieve Basic Healthcare Sum (BHS), and topping up the shortfall whenever it falls below the BHS

- Used cash to top up to my SA via the Retirement Sum Topping Up Scheme (RSTU)

I also used my MA savings to pay the bulk of my medical bill for a day surgery in a government hospital. I then performed a cash top up to my MA and gained tax relief at the same time. By sticking closely to my plan, I managed to achieve Full Retirement Sum (FRS) in my CPF SA in Year 2023.

Knowing where I stand financially and being mindful of my money, along with the confidence that my finances are in good shape, has its perks.

I am confident that as long as I stick to my plan and budget, and proactively fine-tune my approach as needed, I maintain the flexibility to adapt to any changing circumstances. I would therefore be able to stay on track to reach my retirement goals. This certainty provides me with a sense of reassurance, minimising my stress and anxiety for the future.

If you’d like to find out more about how to make the best use of your CPF for your future, visit here.

Disclosure: This article is written in collaboration with CPF Board but the views expressed here are my own.

This article was first published on Heartland Boy. Information in this article is accurate as of date of publication.

.jpg)