12 Jan 2024

SOURCE: CPF Board

Healthcare planning is an important part of safeguarding your wellbeing, and one important aspect is hospitalisation care. When venturing into purchasing hospitalisation insurance, it’s imperative to understand what your needs are, and what kind of coverage out there is best suited for them. This helps you stay prepared to make well-informed decisions if the unexpected does occur.

What do I need to know?

The first thing you need to do is familiarise yourself with what is currently available to you. That means understanding what MediShield Life and MediSave are, as all Singapore Citizens and Permanent Residents have a MediSave Account and are automatically covered by MediShield Life.

Your MediSave is your personal healthcare savings that you can use to pay for healthcare expenses, be it your own or your loved ones’. When you’re working, you save between 8% and 10.5% of your monthly salary into your MediSave, which can then be used for outpatient care, inpatient care, rehabilitation and so on. It can also be used to pay for your MediShield Life premiums, which brings us to the next point.

MediShield Life is a health insurance to help you pay for large hospital bills and selected outpatient treatment costs. You can also use it to pay for hospitalisation or day surgery, including payment for public hospital wards up to class B2/C wards. For non-subsidised wards above Class B2, while you are still able to benefit from MediShield Life, it will only cover a smaller portion of the bill as such bills are much higher. The annual premiums can be fully paid using your MediSave or a family member’s MediSave, which is one less thing to worry about. MediShield Life is sufficient if you are plan to seek subsidised treatments in public hospitals only.

For options beyond what you already have, consider the Integrated Shield Plan, but be conscious of its long-term affordability.

What is the Integrated Shield Plan (IP)?

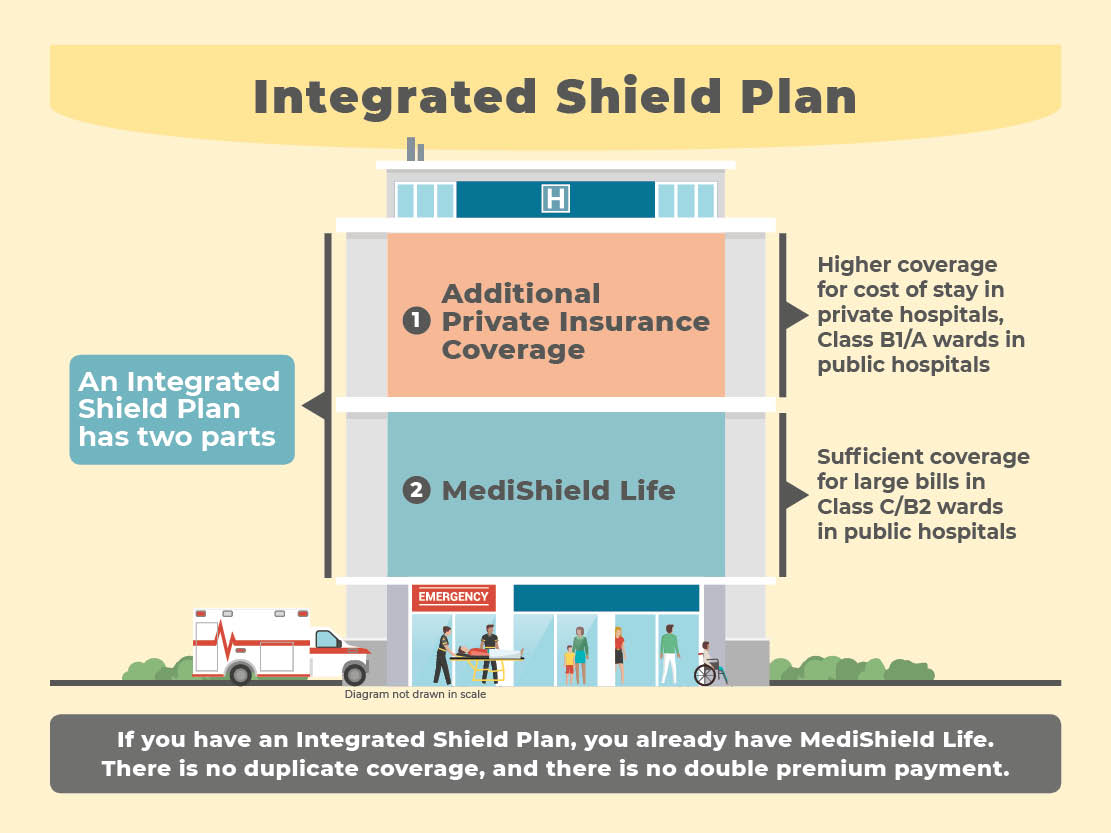

IP is a private medical insurance plan that provides you with additional coverage on top of what you already have under MediShield Life. To do so, it combines MediShield Life with an additional private insurance coverage component provided by a private insurer.

There are a variety of different plans under IP to choose from. This list of plans gives you a good idea of what is offered should you be keen on getting an IP. However, before you do, there are some questions you should ask yourself:

The simple answer is: your hospitalisation bill will increase substantially. While MediShield Life provides sufficient coverage for bills for Class B2 and C in public hospitals, it cannot fully cover bills for Class A and B1 wards or from private hospitals.

If you’re comfortable with Class B2 or C wards in public hospitals, and do not see yourself utilising a higher class ward or visiting private hospitals, then MediShield Life is sufficient for your needs. However, if you prefer a higher class ward, or if you wish to go to a private hospital, or choose your own doctors, MediShield Life is no longer sufficient and you will need additional coverage. In this case, IP is an option that provides such additional coverages, allowing you to have the options should you require them.

Take for example:

- A common medical procedure in Singapore is the heart bypass surgery.

- As shown in the table, the median medical bill ranges from $6,400 to $83,500, out of which you will have to pay the deductibles, co-insurance and whatever is in excess of any applicable IP limits.

- You will have to pay a sizable amount, especially if you choose to stay in unsubsidised wards, ranging from $5,900 to $11,500 (~4 to 5 times more than subsidised wards).

Calculations are rounded to the nearest hundreds.

1 Bill amount is taken from MOH’s website – Fee Benchmarks and Bill Amount Information (data from July 2019 to December 2020), at the 50th percentile across the bills gathered from Singapore Citizens.

2 This is the amount Insured has to pay after deducting hospital subsidies and MSHL/IP payouts, where applicable. It assumes patient admitted is below the age of 81 years old, and holds an IP whose ward coverage is pegged to their actual ward stay. Please approach your Insurer for your individual IP benefits as they may differ and/or change from time to time.

As the additional IP coverage is provided by a private insurer, it also means you must pay additional premiums, on top of what you are already paying for MediShield Life. The amount to be paid depends on your chosen plan, and do note that the private medical insurance coverage component could be up to five times the MediShield Life premiums when you are in your 70s or 80s, and are no longer working.

Comparison of premiums between MediShield Life and Integrated Shield Plans (IPs)

1 . Your MSHL premium may differ depending on your premium subsidies, premium rebates and whether you need to pay for Additional Premiums (which is a nominal 30% for 10 years only if you have a serious pre-existing condition). The net MSHL premium payable after accounting for these is fully payable by MediSave.

2. Excludes plans which are no longer offered to new customers.

3. This is the maximum MediSave that can be used to pay premiums of the private medical insurance coverage, beyond which cash payment is required.

In addition, if you’re mainly looking to opt for subsidised care in public hospitals, you will not be maximising your IP coverage. Thus, it’s best to consider how likely you are to maximise your IP coverage before deciding on it. If you’re not likely to “make full use of it”, then the additional premiums may not be worth it. Furthermore, IP premiums are not fixed and can be increased in the future due to inflation, meaning you are likely to be paying more by the time you retire as opposed to the indicative premiums shown for the various age groups when you first bought the plan.

While MediShield Life premiums are fully payable using MediSave, the private medical insurance component of IP premiums is payable only with MediSave up to the AWLs. Any excess needs to be paid in cash. As you get older, you may need to pay a larger amount of your IP premiums in cash, depending on the IP you choose.

AWLs for IP Policyholders |

|

Age next birthday |

AWLs |

1 - 40 |

$300 |

41 - 70 |

$600 |

71 and above |

$900 |

The final consideration is whether paying for such IP premiums would be an efficient use of your MediSave. Remember that your MediSave Account (MA) savings grow at a steady rate of 4% (and above), and these savings can be used to meet your future healthcare needs. What’s more, any additional amount on top of the Basic Healthcare Sum (BHS) will be transferred to your Special Account or Retirement Account, which in turn can boost your monthly payouts when you retire. Thus, to go for an IP or not depends on whether you need and would utilise the options that come with an IP. . Do keep in mind that you will still be covered under MediShield Life even if you chose to terminate or downgrade your IP.

If you wish to learn more about the options available, you can check out the supplementary healthcare coverage page, which has information on IP and more!

The information provided in this article is accurate as of the date of publication.

.jpg)