11 Jul 2025

SOURCE: CPF Board

In life, mutual care and support is indispensable. Apart from showing this to your loved ones in the day-to-day moments, a key way is also by helping each other get ready for retirement.

While CPF contributions can help build your retirement nest egg during your working years, it is by no means the only method to grow your savings. One other way to make good use of CPF’s interest rates is to make cash top-ups or CPF transfers to your CPF account, such that your savings can grow at an even faster rate.

However, top-ups are not restricted to your own accounts. You can make top-ups to the accounts of your loved ones to help them grow their savings too! Be it for your spouse, your children, your parents or your siblings.

Top-ups via cash or CPF transfer can be made to their Special (below age 55) or Retirement (age 55 and above) Accounts, which enjoys an interest rate of up to 6% per annum1.

1 RA balances currently earn a minimum interest rate of 4% a year, compared to a minimum of 2.5% in the OA. Members aged 55 and above earn an extra interest of 2% per annum on the first $30,000 and 1% per annum on the next $30,000 of their combined CPF balances (capped at $20,000 for OA).

One benefit is being able to enjoy tax relief of up to $8,000* for cash top-ups made to your loved ones in each calendar year, in addition to the $8,000 for top-ups made to yourself. This applies to cash top-ups up to the current year’s Full Retirement Sum (FRS).

For cash top-ups made to eligible seniors, the Government will match every dollar of cash top-ups made to their Retirement Account (RA), up to $2,000 per year, with a lifetime limit of $20,000. This is part of the Matched Retirement Savings Scheme (MRSS), which is meant to help senior members with lower retirement savings boost their monthly payouts in retirement.

Every member’s eligibility is automatically assessed every year by the CPF Board, and you will be notified at the beginning of each year if you qualify.

While tax relief is not given for top-ups to your children’s accounts, helping them top up their Special Account (SA) via the Retirement Sum Topping-Up Scheme (RSTU) or their MediSave Account (MA) can be good ways to help them start planning for their future.

*Cash top-ups which attract the matching grant will not enjoy tax relief.

Besides cash top-ups, you can also transfer your CPF savings to your loved ones, and vice-versa. While CPF transfers do not qualify for tax relief, these transfers can also go a long way to boosting retirement savings.

Before making transfers to your loved ones, it’s important to first set aside enough for your own retirement. After all, you can only care well for others, if you have taken care of yourself first. This also applies when making transfers to your own SA or RA – you should first consider what you need to use your OA for, and ensure you have enough, before making any transfers.

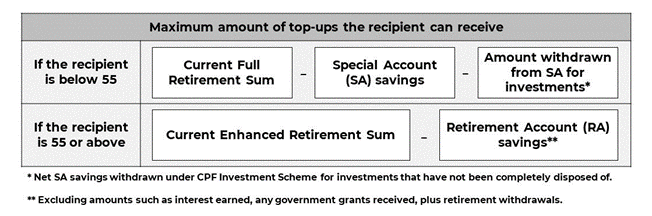

How much cash top-ups your loved one can receive is dependent on the recipient’s age:

If the recipient is below 55 years of age, the maximum amount is the current Full Retirement Sum (FRS) minus the Special Account (SA) savings and amount withdrawn from SA for investments (net SA savings withdrawn under the SPF Investment Scheme for investments that have not been completely disposed of).

If the recipient is 55 years of age or above, the maximum amount is the current Enhanced Retirement Sum (ERS) minus the Retirement Account (RA) savings (excluding amounts such as interest earned, any government grants received, plus retirement withdrawals).

To help visualise the differences in the top-up limit, here is a handy picture to summarise:

As for how much CPF savings you can transfer to your loved ones, it depends on your relationship with the recipient and on your age:

For one’s spouse:

You can transfer from your OA savings, after setting aside the current Basic Retirement Sum (BRS).

For one’s parents and/or grandparents:

If you own a property (includes accrued interest), you can transfer your OA savings after setting aside the current BRS, provided you can meet the current Full Retirement Sum (FRS) with your OA savings, SA savings, the net amount withdrawn for investments and property.

If you do not own a property, you can transfer your OA savings after setting aside the current FRS.

For one’s siblings, parents-in-law and/or grandparents-in-law

You can transfer your OA savings after setting aside the current FRS.

For one’s spouse:

You’ll be able to transfer from your CPF savings, after setting aside your BRS. Do note that your OA savings will be transferred first, followed by your RA savings.

For one’s parents and/or grandparents:

If you own a property (including accrued interest), you can transfer your CPF savings after setting aside your BRS, provided you can meet your FRS with your OA savings, RA savings, net amount withdrawn for investments and property.

If you do not own a property, you can transfer your CPF savings after setting aside your FRS.

For one’s siblings, parents-in-law and/or grandparents-in-law

You can transfer your OA savings after setting aside your FRS.

Before you make a top-up, you can use the Retirement dashboard as a tool to help you with how much cash top-ups and CPF transfers you can make, to yourself or your loved ones. It can also tell you the remaining tax relief you can enjoy for the calendar year, to better help you decide how much to top up. You can also use the dashboard to check your MRSS eligibility.

Secondly, it’s important to note that both top-ups via cash and CPF transfers are irreversible. The savings in the Special Account or Retirement Account earn a higher interest rate as they are meant to build up one’s retirement savings and cannot be withdrawn for other purposes. Because of this, it’s important to consider your different needs before proceeding with your top-ups and/or transfers!

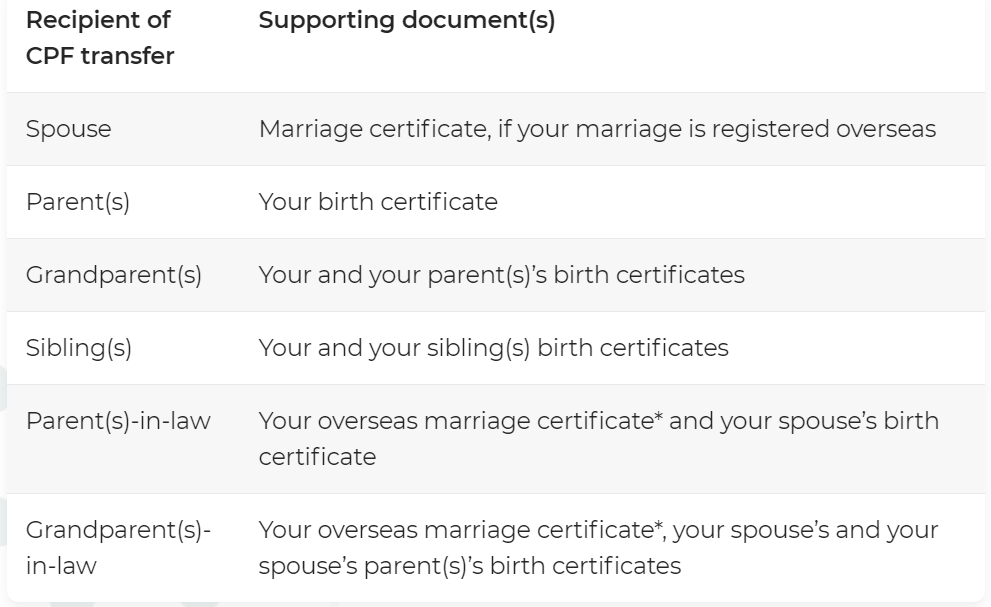

Finally, you need to know what documents to prepare in order to make a cash top-up or CPF transfer. In order to complete your top-up form, you will need:

- Your recipient’s NRIC, if you are making a cash top-up or CPF transfer to a loved one

- Additional documents if you are making a CPF transfer to a recipient for the first time. The list of recipients and the corresponding documents are as follows:

*Not required if your marriage is registered in Singapore

Giving a helping hand allows your loved ones to move one step closer to living their desired retirement lifestyle.

Take the first step towards a secure future by planning together with CPF. PLAN with CPF empowers you to manage your financial wellbeing, make informed decisions at every life stage, and build a strong foundation for retirement using your CPF savings.

The information provided in this article is accurate as of the date of publication.

.jpg)