28 Feb 2023

SOURCE: CPF Board

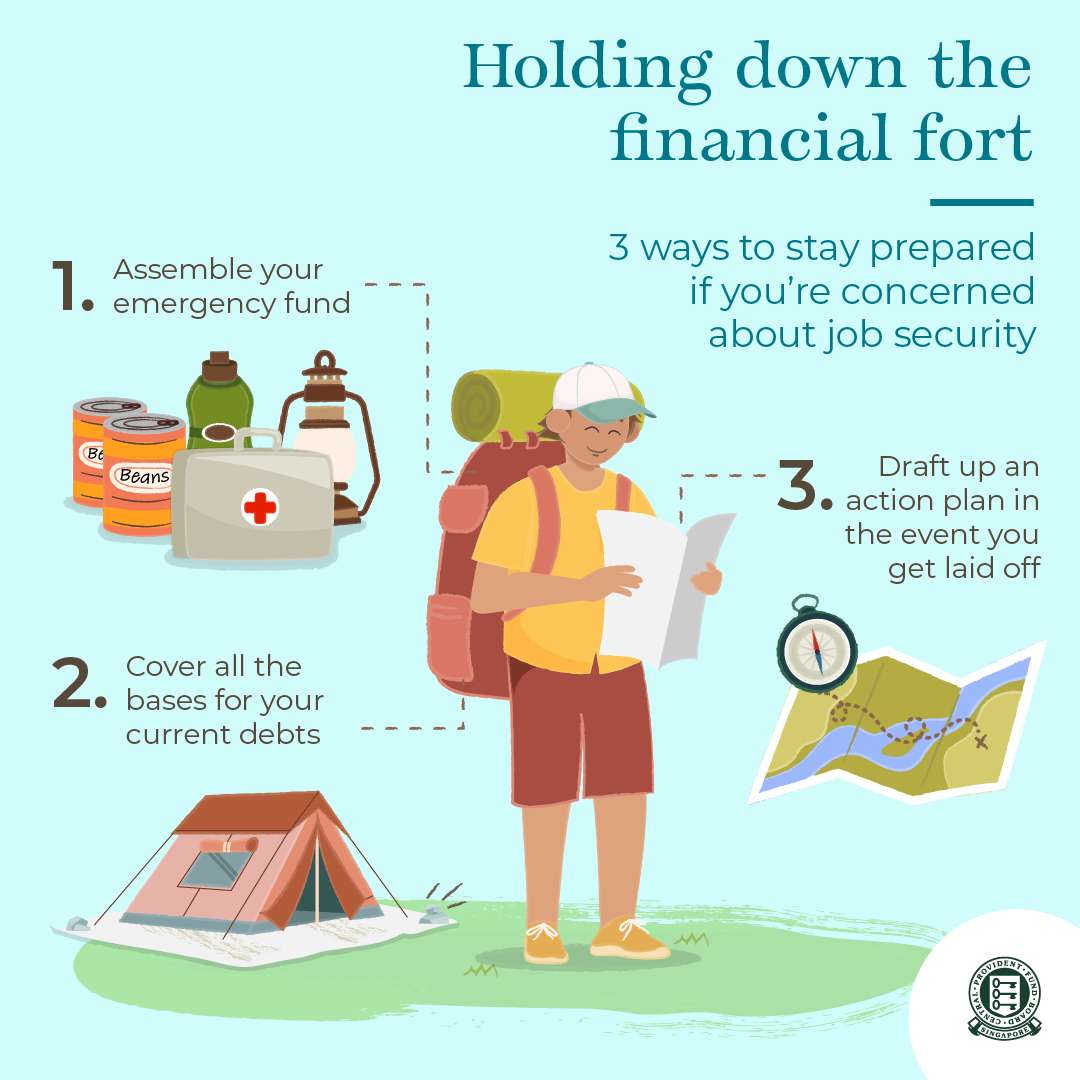

You may have seen news about tech layoffs recently, and wondered what you would do if you’re ever faced with retrenchment. While it can be hard to foresee a retrenchment, one thing you can do is to stay financially prepared for such unforeseen events, so that you can focus your time and energy on bouncing back and finding new job opportunities. Here are 3 ways you can do so.

1. Assemble your emergency fund

First things first: do you have emergency savings to cover at least six months of expenses set aside for unexpected events such as accidents or sudden job loss? This is crucial for any working adult — even more so if you have children or other dependants.

One way to buff up your emergency fund is to automate a transfer of a portion of your monthly salary into a separate account. A good rule of thumb is 10% to 20% of your salary. You will want to be able to withdraw your emergency funds easily when the need arises, so consider leaving them in a high-interest savings account.

If you want to build your emergency fund in a shorter period, or if you have difficulty setting aside 10% to 20% each month, track and review your expenses to see which expenses could be potentially cut. For instance, perhaps you could make do with 1 streaming service subscription instead of 3. Or you could work out at home instead of paying for a gym membership. By cutting these non-essential expenses out, you should have extra cash to put towards your emergency fund.

2. Cover all the bases for your current debts

While it’s important to sock away any extra to your emergency fund, it’s also necessary to take into account any debt you may have.

If you have high-interest debts like credit card bills, prioritise paying them off ASAP, as it’ll be much harder to handle without a steady income. Start with the ones that incur the highest interest. If you have issues paying it in full at the moment, make a plan to pay it off in parts within a certain time frame.

For your housing loan repayments when you’re in between jobs, if you have been paying with a combination of cash and CPF, you can choose to service your monthly mortgage using just your CPF Ordinary Account (OA) savings instead.

P.S. This is why it’s recommended to retain up to $20,000 in your OA when buying a home! Head here to find out more benefits of not wiping out your OA.

3. Draft up an action plan in the event you get laid off

Lastly, write out the steps to take if you do get retrenched. Being retrenched can make you feel discouraged and stressed. Having a plan that you can easily execute can relieve some of the mental load.

For example, one of the steps can be to keep your resume and/or portfolio updated, so that you can start applying for new jobs quickly. Another step can be to reach out to trusted friends or ex-colleagues for referrals as they may have potential opportunities to recommend.

While you’re hunting for a new job, you can also consider picking up a temporary or part-time gig to tide you over, such as doing freelance work or delivering food. Research the processes involved ahead of time so that you’re ready if the time comes.

Besides finding potential income, it also helps to cut back on spending during a period of job loss. For instance, not going to the movies or not dining out with friends.

If you have served the company for at least 2 years, you’ll be eligible for retrenchment benefit. The amount depends on your employment contract, but the prevailing norm is to pay a retrenchment benefit of between 2 weeks to 1 month's salary per year of service, depending on the company’s financial position and the industry. Those with less than 2 years of service could be granted an ex-gratia payment out of goodwill.

Read more about retrenchment benefits on the Ministry of Manpower’s website.

Dealing with retrenchment can feel overwhelming. Amidst adjusting your finances for this tough period, remember to take time for yourself — read a novel, go for a jog or even catch a TV show you never had time for. Maintain an open mind and be receptive to new opportunities and possibilities that may arise. You’ve got this!

Information presented is accurate as of the date of publication.