27 Oct 2023

SOURCE: CPF Board

If you're planning to buy an HDB flat, the first step is to get an HDB Flat Eligibility (HFE) Letter.

Here’s all you need to know.

What is an HDB Flat Eligibility (HFE) letter?

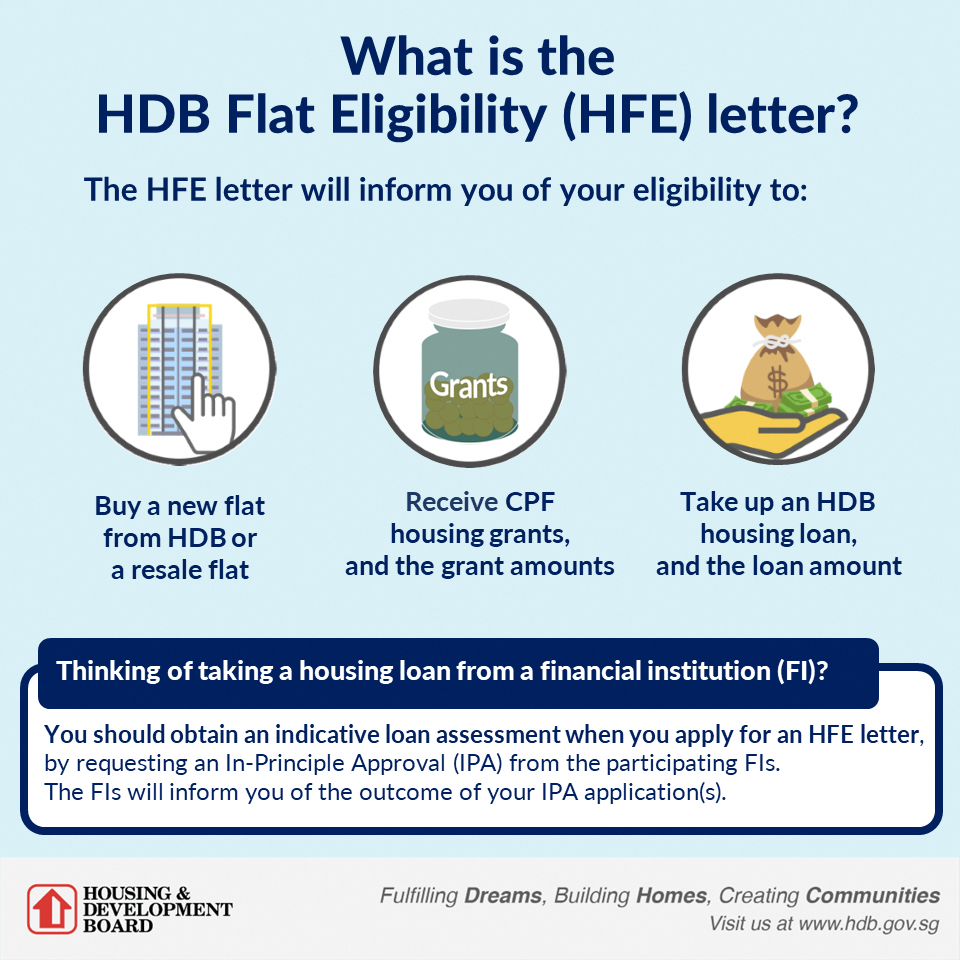

The HDB Flat Eligibility (HFE) letter gives homebuyers a consolidated assessment of their housing and financing options, with the aim of making the flat-buying process easier. With a single application, you will know upfront if you are eligible to:

- Buy a new or resale HDB flat

- Receive CPF housing grants and the grant amount

- Get an HDB housing loan and the loan amount

Source: HDB

When do you need an HDB Flat Eligibility (HFE) letter?

Buying a new flat - Before the Build-to-Order (BTO), Sales of Balance Flat (SBF) sales launch, or open booking.

Buying a resale flat* - Before getting an Option to Purchase (OTP) from the seller, and before submitting the resale application.

*If you have a valid Intent to Buy (ITB) and a valid HDB Loan Eligibility (HLE) letter for an HDB housing loan, you can proceed to get an OTP from the seller and submit your resale application without an HFE letter.

How to apply for an HDB Flat Eligibility (HFE) letter?

There are two steps:

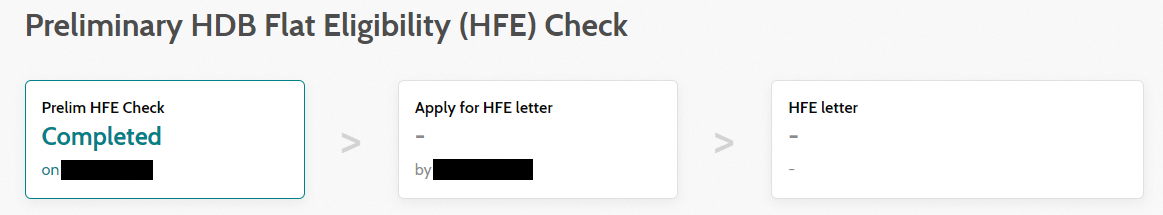

Step 1: Complete the Preliminary HFE Check

Login to the HDB flat portal using your Singpass. You can use Myinfo to retrieve your details and update accordingly if there are any changes. You’ll need to do the following:

- Provide the particulars of all flat applicants and/or occupiers.

- Declare any interest in local and/or overseas private property.

- State your intention in taking up a housing loan.

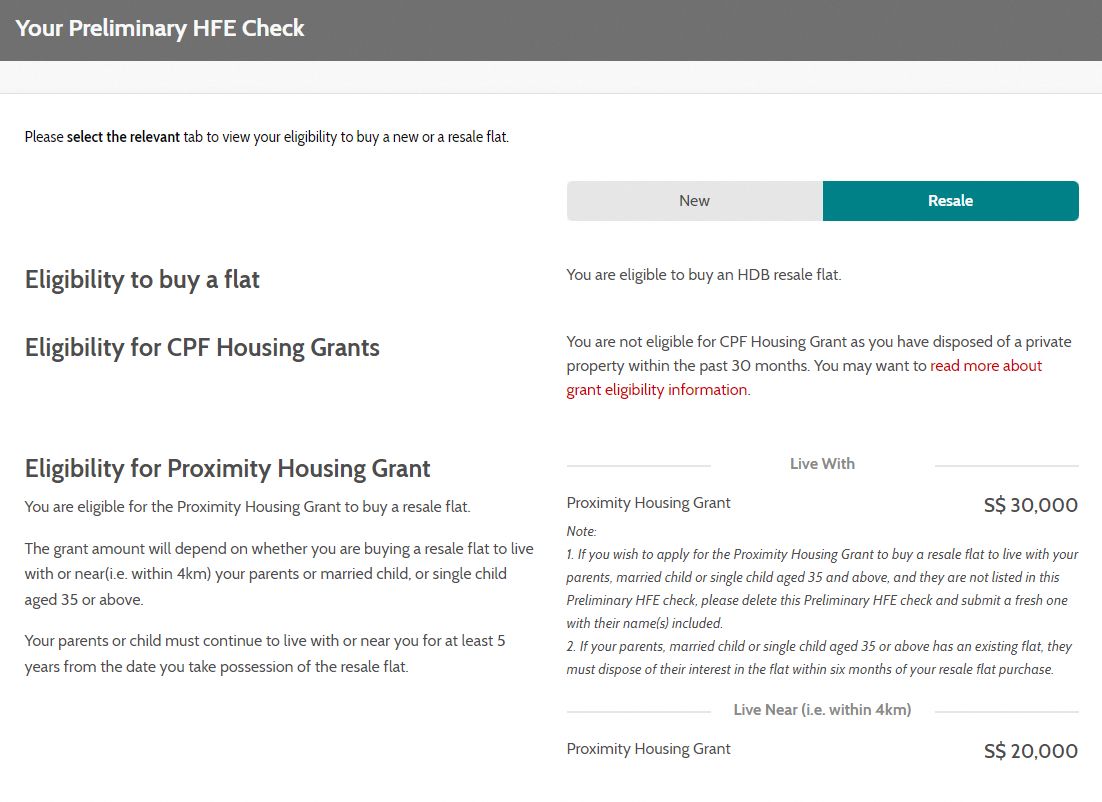

Review the information you have provided. Upon submission, you will receive a preliminary assessment of your eligibility to buy an HDB flat, receive CPF housing grants and take up an HDB housing loan.

Once you have completed the preliminary check, you can proceed to apply for an HFE letter.

Step 2: Apply for an HFE letter

Login to the HDB flat portal using your Singpass.

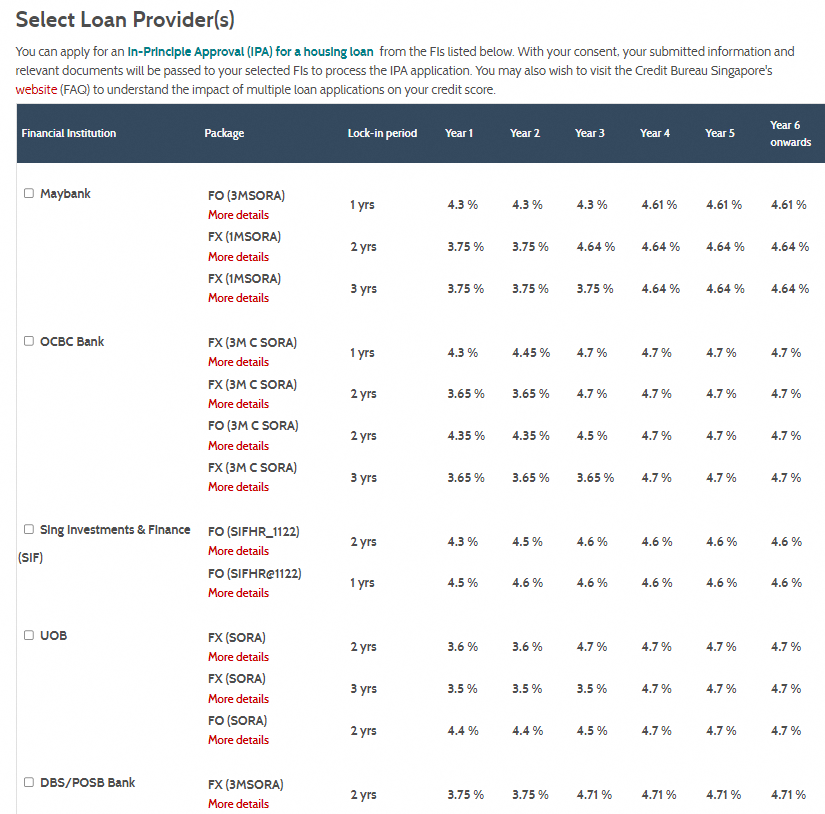

You must first confirm if you intend to take up a housing loan to buy the flat. If so, you will need to select your housing loan options from HDB and participating financial institutions (FIs).

You can do the following:

- Check your HDB housing loan eligibility and different loan scenarios.

- Compare housing loan packages from HDB and the participating FIs.

You can also request for an In-Principle Approval (IPA) from the FIs for an indicative loan assessment.

You will then be asked to provide additional details and upload supporting documents, such as your particulars and CPF contribution history.

After you have reviewed the information provided, submit the application.

Receive HDB Flat Eligibility (HFE) letter

Once your HFE letter is ready, you will be notified via SMS to log in to the HDB Flat Portal. Do note that it is only valid for nine months.

When you receive your HFE letter, it means you are ready to start your home ownership journey. Congratulations! However, remember that home ownership is a long-term commitment, so it is important to be prudent and plan carefully. Here are some tips and resources you can use:

- Consider your budget and financial goals - check out these essential budgeting tips for your BTO flat

- Be prepared for the lesser-known expenses - home ownership comes with a variety of expenses such as property taxes, insurance, and maintenance costs.

- Safeguard your home – protect you and your loved ones with the Home Protection Scheme.

By following these tips, you can start your home ownership journey on the best foot. Good luck!

Information in this article is accurate as at the date of publication.