17 Nov 2023

SOURCE: CPF Board

The best time to start your financial journey was yesterday, but the next best time is today. It’s never too late to start, regardless of your age or current life stage.

If you're in your 40s and part of the sandwich generation contending with higher living costs as you support both your children and elderly parents, you know that financial planning is more important than ever.

You can't change the past, but you can start today to create a better future. Here are 4 steps you can take to put together a holistic financial plan for you and your family.

A good place to start is to assess your current financial situation, including your personal and household finances.

The first step to managing your money better is to know where it's going.

Once you better understand your spending habits, you can start to allocate your money more effectively. A good budgeting guide is the 50/30/20 rule, which divides your income into three categories:

50% needs: your essential expenses, such as housing, food, and transportation

30% wants: the things you want, such as entertainment and shopping

20% savings/investments: for your future needs

If you are currently spending a huge portion of your income on wants, you might need to make some changes.

Make a list of all your outstanding debts, including the interest rate and minimum payment for each one. This will help you get a better understanding of your overall debt and choose the debt repayment method that is best for you. Examples include:

Snowball method: paying off your debts from smallest to largest, regardless of interest rate. This can be motivating, as you see your progress.

Avalanche method: paying off your debts from the highest to lowest interest rate, regardless of balance. This can save you money on interest in the long run, but it may be less motivating, as it can take longer to see your progress.

Debt consolidation: combining multiple debts into a single loan with a lower interest rate. This can be a good option if you have high-interest debts, but it is important to make sure that you can afford the monthly payments on the new loan.

It is also important to pay your credit card bills and instalment plans on time to avoid accumulating interest and incur penalties, which will ultimately become bad debts.

Make sure you have enough insurance coverage for yourself and your dependents. However, avoid over-coverage, as this can be a waste of money.

Learn how to plan for your healthcare insurance.

Your earning potential doesn't wane just because you're no longer in your 20s or 30s. In fact, your income has likely increased significantly by this point in your career.

You’ll still have two or even three decades to continue maximising your money, given that Singapore's average life expectancy is 83 years old.

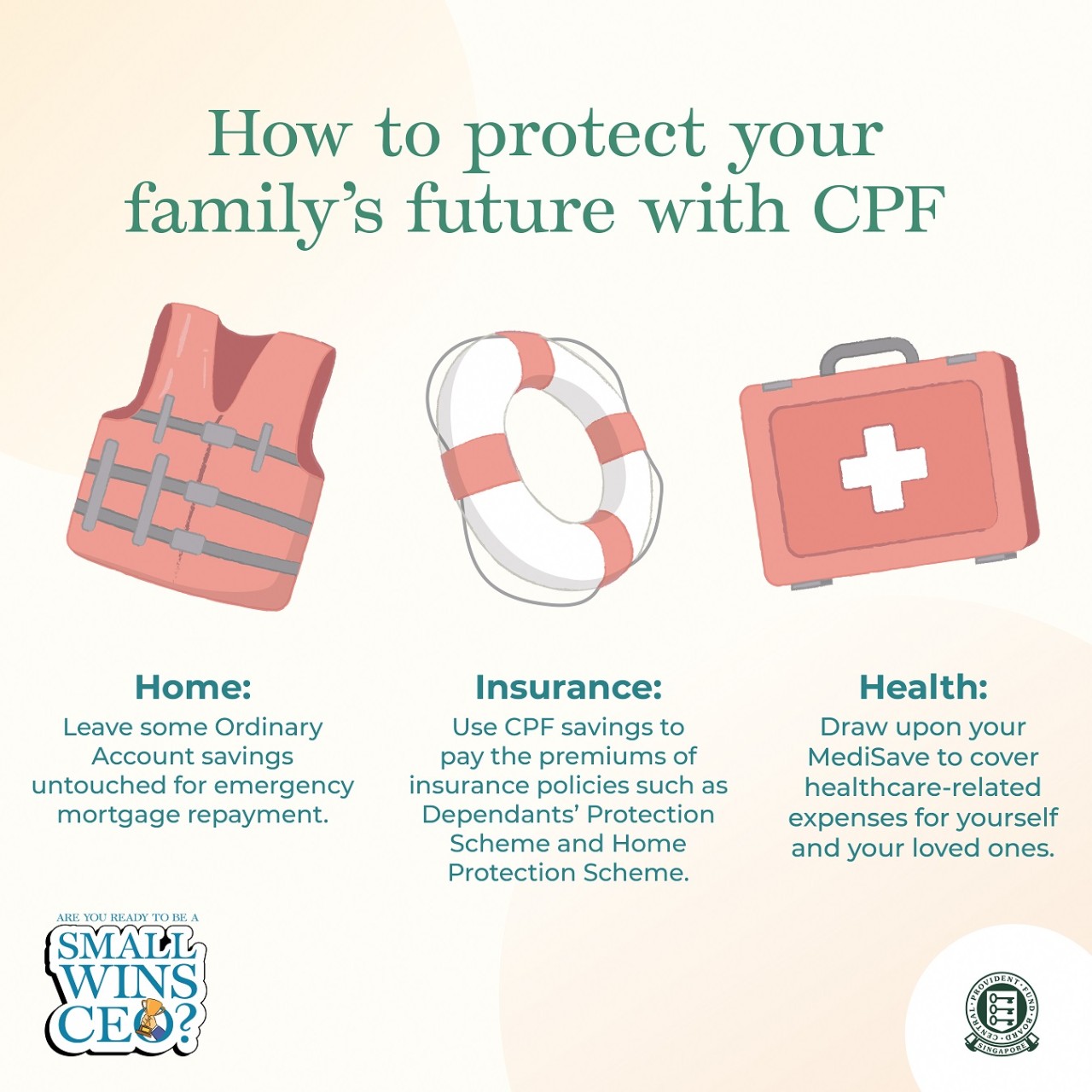

Here are 3 ways to safeguard your family’s financial stability:

You should also start planning for your child’s tertiary education early. University fees have been rising steadily for many years, and it is expected to continue doing so.

By planning early, you can help them to achieve their educational and career goals without having to worry about the financial burden of student loans. Since you have ample time to build their education savings, you can consider investing in low to moderate-risk assets that have the potential to grow over time.

At the same time, don’t forget about your own retirement. Learn how to achieve your goals one small win at a time.

You are likely at your highest earning potential at this point in life with some runway until retirement, which gives you the flexibility and time to consider investment options.

Depending on your risk appetite, you can invest in assets with long-term growth potential like stocks and REITs. However, as you get closer to retirement, you might want to diversify your portfolio to include more low-risk assets such as bonds and fixed deposits.

Here's all you need to know about investments in Singapore.

Your CPF is like a sturdy anchor that keeps your (retirement) ship afloat even in rough seas.

CPF provides you with a lifelong income in your golden years, but it also serves a safety net that can help you to maintain your financial security in retirement – by supporting your healthcare (or even housing) expenses.

This is a good investment because it’s risk free and up to 5% per annum, and the power of compound interest can help to grow your savings exponentially.

Maximise your CPF interest by making cash top-ups to your Special Account (SA). Small, regular contributions can go a long way towards meeting your retirement goals. As a bonus, you might be eligible for tax relief when you make a top-up!

You can consider making a top-up to your parents’ Retirement Account (RA). The savings can grow at up to 6% per annum in their RA and will increase their CPF LIFE monthly payouts.

If you have additional cashflow, consider making a voluntary housing refund of your Ordinary Account (OA) savings used for your home. You can then take advantage of CPF's interest rates to boost your CPF savings and also use the refunded CPF savings for other CPF approved schemes if needed.

Financial planning in your 40s may involve lots of figures and calculations, but it's an investment in your future. Money can help you achieve your goals, but having a fulfilling life is ultimately about knowing what you want.

Once you identify those needs, every financial decision can help you prepare for your best life, now and in retirement. Get useful tips and resources to help you make better financial decisions for your life goals, starting today!

Information in this article is accurate as at the date of publication.

.jpg)