29 Sep 2023

SOURCE: CPF Board

With 20% of your monthly salary going into your CPF accounts, you might wonder: why do I need CPF?

In the first instalment of the CPF Answers Series — where we answer your most pressing questions — learn more about CPF and why it matters to you!

CPF: Singapore’s social security system

Some might see CPF as merely a pension plan, but it is much more and serves as a comprehensive social security system.

Think of a social security system as a community garden that provides support when you need it. Just as how planting seeds in a garden result in luscious crops that grow over time, your CPF contributions continue to grow during your working years and can be “harvested" when you reach retirement age or have certain essential needs such as buying a home.

Without this community garden, you will have to budget and plan for everything by yourself, which include saving for your housing, retirement, and healthcare needs.

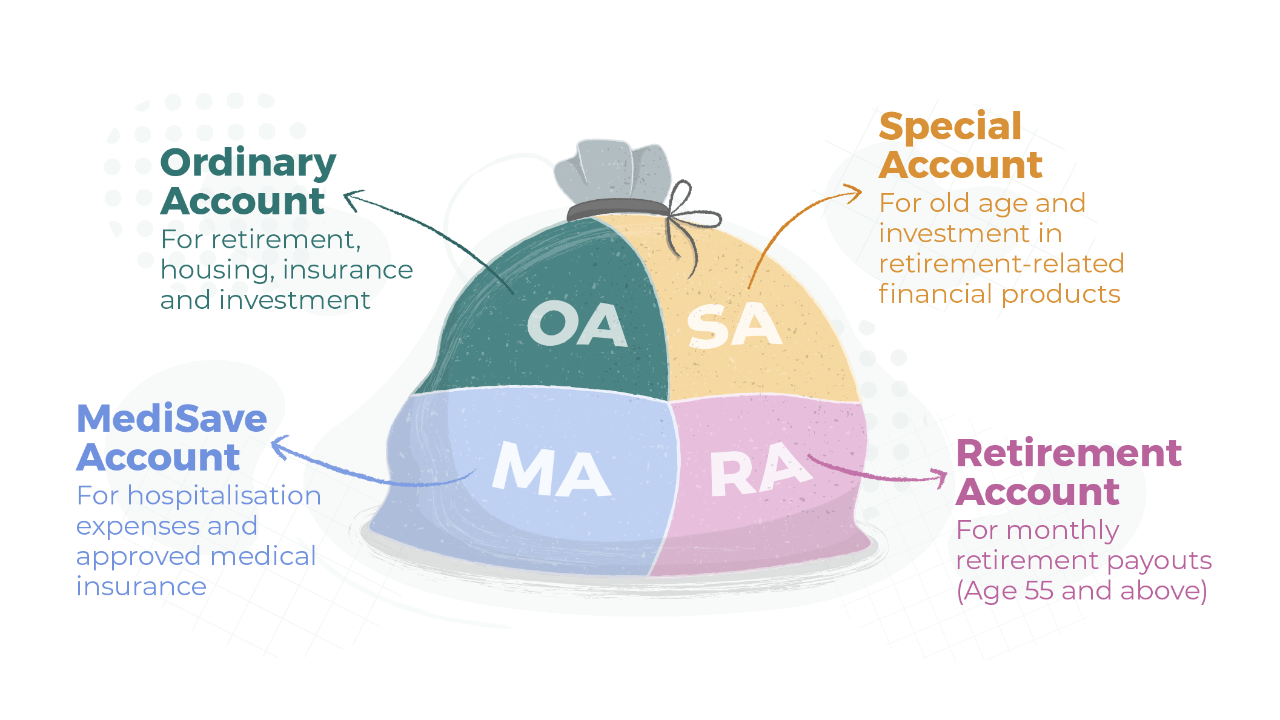

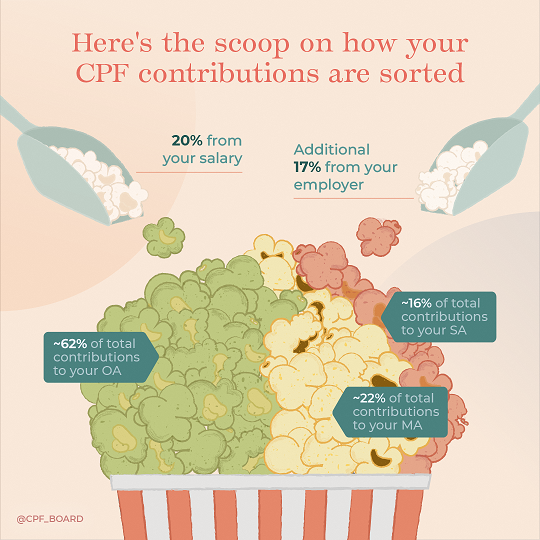

How your CPF contributions are allocated

20% of your monthly pay is a considerable amount of money, so it’s good to know where it goes. Along with the contribution from your employer, the combined amount is known as your CPF contribution* and is allocated to your relevant CPF accounts.

The amounts to be allocated into your Ordinary Account, Special Account, and MediSave account vary according to your age. Check out the CPF allocation rates to find out more about how your CPF contributions are distributed.

*The figures in the illustration are rounded up to whole numbers. The rates apply to Singapore Citizens and Singapore Permanent Residents (from third year and onwards), 35 years old and below, and earning a total monthly wage of above $750.

CPF covers your basic retirement needs

The CPF system acts a safety net, making sure that the three basic needs of retirement are served: a fully paid-up home, insurance and savings for healthcare, and a steady stream of lifelong retirement income.

1) A fully paid-up home

Buying a home is a major purchase. CPF gives you a good foundation by encouraging early savings for your first home. Over time, the CPF interests earned will compound, and your savings will build up.

By saving from your first pay cheque, paying the down payment for your first home is much easier when you need it later in your life.

Check out these essential financing tips for buying your first home!

2) Healthcare

Falling ill can happen to anyone at any time. Setting aside a portion of your savings for healthcare serves as a safety cushion that provides you with peace of mind.

Here’s what you can use your MediSave savings on:

Insurance: Your MediSave can be used to pay the insurance premiums for MediShield Life, a scheme that provides Singaporean citizens and Permanent Residents with lifelong protection against large hospital bills and selected outpatient costs. Regardless of your age or health condition, you will be covered for life.

Medical bills: Medical bills can be a significant expense, even with insurance. MediSave helps to ease the financial burden by covering a portion of costly hospital bills using funds directly from your MediSave savings. This means you may not have to pay the full amount in cash, offering you financial flexibility when it's most needed.

Long-term care: You can use your MediSave to pay the premiums for CareShield Life, a long-term care disability insurance scheme. It provides monthly payouts, ensuring that your long-term care needs are met in the event that you become disabled

3) Lifelong retirement income

Even though retirement may seem distant when you start your first job, CPF can help you prepare for it from day one.

A portion of your CPF contributions goes to your retirement savings in your Special Account from the moment you begin working. As you get older and retirement nears, a higher amount is allocated to your retirement savings to ensure that you are prepared for your golden years.

When you reach age 55, your CPF savings of up to your Full Retirement Sum (FRS) will be set aside in your Retirement Account to provide you with monthly payouts in retirement. You will also be able to withdraw at least $5,000 or any amount in excess of your Full Retirement Sum (or Basic Retirement Sum if you own a property) whenever you have immediate needs.

Starting at age 65, you can choose to start receiving monthly payouts from your Retirement Account. These payouts serve as a reliable monthly income that supports you for as long as you live. Even if the balance in your Retirement Account runs out, you will still continue to receive monthly payouts thanks to CPF LIFE.

The importance of CPF in covering your basic retirement needs

The monthly CPF contributions during your working years are more than just deductions. They are investments in your future that help to provide the foundation for essential needs such as healthcare, housing, and retirement.

Keep working hard in your working years, and when the time comes, you will enjoy the fruits of your labour. It will be well worth the effort!

The information provided in this article is accurate as of the date of publication.