7 July 2023

SOURCE: CPF Board

Your CPF plays a crucial role in your future, through building your retirement savings and taking care of your basic housing and healthcare needs. Your CPF savings has steadily grown since you started working, and once you turn 55, there are a few decisions you’ll have to make.

From age 55:

- Your Retirement Account (RA) will be created for you when you turn 55. Your CPF savings from your Special Account (SA) and Ordinary Account (OA) will be transferred to your RA, up to your Full Retirement Sum (FRS). Your Special Account (SA) savings will be transferred first, followed by your Ordinary Account (OA) savings.

- For higher payouts in retirement, you can top up your RA to the Enhanced Retirement Sum (ERS).

From age 65 (for those who are on CPF LIFE):

- You will be eligible to start receiving your monthly CPF payouts.

- There will be a second transfer at the start of payouts – savings in your OA and SA will be transferred to your RA for the second time. This will increase the amount of savings in your RA and provide you with higher payouts.

- You have the option of starting payouts anytime from 65 to 70 years old. Once you turn 70, you will automatically start receiving your payouts.

- If you are automatically included in CPF LIFE (if you’re born in 1958 or after, and have at least $60,000 in your retirement savings when you start monthly payouts), you can choose your CPF LIFE plan when you wish to start receiving your payouts. Otherwise, you can choose your CPF LIFE plan when you join the scheme, anytime from age 65 to one month before you turn 80.

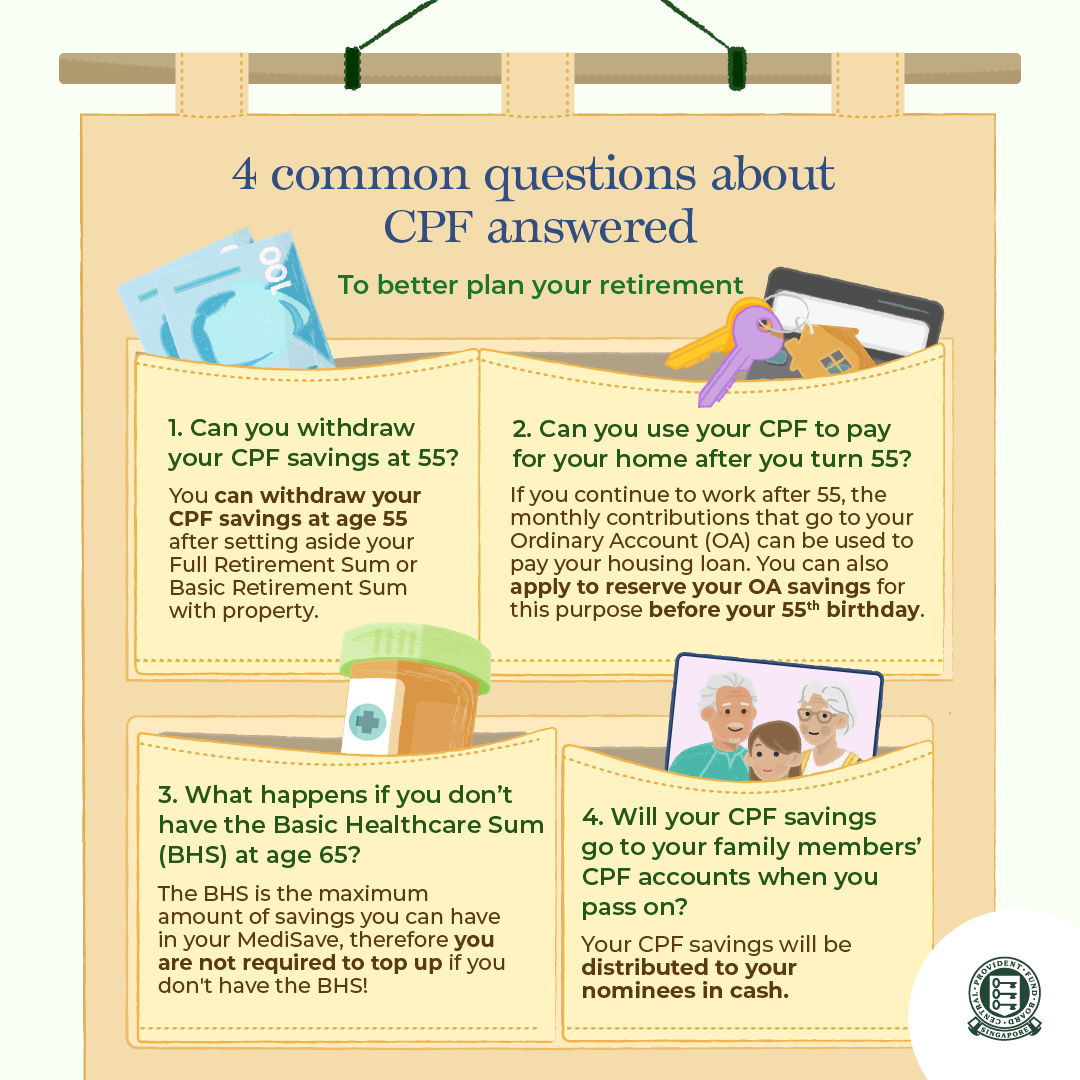

With these important milestones, many questions and misconceptions often arise. In this article, we aim to shed light on 4 common questions about CPF to help you make informed financial decisions.

For those born in 1958 or after, you can also withdraw up to $5,000 unconditionally from age 55. Once you have set aside your FRS, you can also withdraw any remaining OA and SA savings. Property owners in Singapore with a remaining lease that lasts you up to at least age 95 can also withdraw their Retirement Account (RA) savings above their Basic Retirement Sum (BRS).

If you pledge your property, you can withdraw your CPF savings above your BRS. However when you decide to sell your property, you must refund proceeds to your CPF and restore your RA up to the FRS.

What if you don’t have enough to meet the...

BRS: You can still withdraw up to $5,000 from your OA and SA. You will receive monthly payouts based on your retirement savings from age 65.

FRS: You can still withdraw a portion of your CPF savings. If you are aged 65 and above, you can withdraw an additional amount from your RA. Check the “Withdraw for immediate retirement needs” in the Retirement dashboard to see how much you can withdraw from your RA.

You can continue to use the following from your CPF savings to pay your housing loan. This would come from your new CPF contributions to your OA (if you continue working after age 55.

You can apply to reserve an amount in your OA savings before your 55th birthday. If you have done so, the reserved amount will not be transferred to your RA when you turn 55.

However, do note when you start your monthly payouts, your reserved OA savings will be transferred to your RA if you have not set aside your FRS.

The BHS is the estimated savings you will need for basic subsidised healthcare expenses in old age. It is also the maximum amount you can have in your MediSave Account (MA). If you have less than the BHS at age 65, you are not required to top up your MA.

However, if you still want to build up your healthcare savings, you can top up your MA using cash.

Do note that any contributions beyond the BHS will be transferred to your SA or RA. If you have the Full Retirement Sum in your SA or RA, the excess savings will be transferred to your OA.

The BHS is adjusted annually to keep pace with growth in MediSave use by the elderly, ensuring the amount stays relevant for every cohort as they arrive at retirement age. Once you reach age 65, the BHS will be fixed for the rest of your life.

Your CPF savings will be distributed to your nominees in cash. Therefore, it is vital that you make a CPF nomination so that your money can be properly distributed to your loved ones upon your demise.

Do note that your CPF savings are not covered by your will. Hence, if you did not make a CPF nomination, your CPF savings will be paid to the Public Trustee’s Office for distribution to your family member(s) based on the intestacy laws or inheritance certificate (for Muslims). Your loved ones will need to make an online application with the Public Trustee’s Office for your CPF savings to be distributed to them – which will take a period of time and incur a transaction fee.

Find out more about a CPF nomination, including how to make one.

Now that we’ve provided clarity about these common questions about CPF, you’re on your way to making more informed decisions regarding your CPF for a financially sound future!

Information accurate as of date of publication.