3 March 2022

SOURCE: CPF Board

Retirement is an important milestone. It marks the transition from daily hustle to a more relaxed lifestyle—one that rewards you for all the hard work you’ve put in to reach this point.

What supports this lifestyle is your CPF savings, built up over the course of your working life. Because of the important role it plays, it’s only right that ample care and attention is given to it. Here are three tips to help you grow your savings so that you’ll be able to hit your retirement goals!

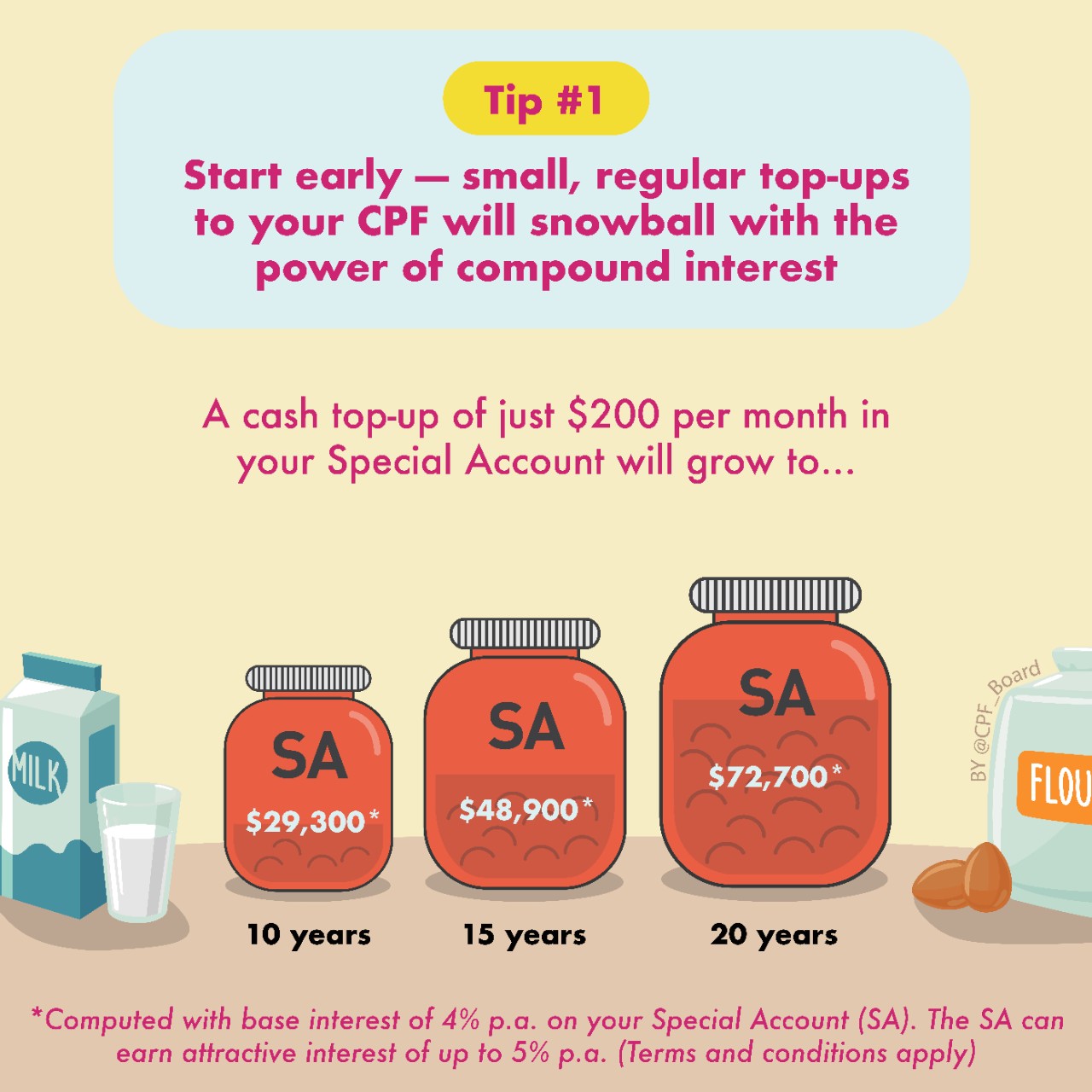

Tip #1: Start early

There’s a Japanese saying that goes: “even dust, when piled up can become a mountain”. And of course, there’s the western saying: “Rome was not built in a day”. Combining these sayings gives you the first tip of today: start early, even if you start small.

CPF’s attractive interest rates help your savings grow fast through the power of compounding. And it’s easy to make them grow even faster! By topping up early, you give your savings more time to accumulate interest, earning you more in the long run. Even small top-ups can go a long way if you make them early and consistently!

Tip #2: Give your Ordinary Account (OA) the attention it needs

A common use for OA savings is to repay your home loans. While it can indeed be used for that, it doesn’t mean you should empty your OA just for that purpose!

As we’ve covered in the previous tip, CPF offers attractive interest rates to grow your savings. Because of this, it’s recommended that you do not deplete your OA, but use a mix of cash and CPF to repay your home loans instead. This way, your OA savings can continue to benefit from those attractive interest rates, allowing them to not only support your housing needs, but your retirement needs too!

Tip #3: Plan ahead

Specifically, plan for the kind of life you want to live in retirement. Do you plan to dine out every week? Perhaps travel every few months? The kind of retirement lifestyle you wish to live will determine how much monthly payout you require.

CPF LIFE will cover you no matter how long you live, but how much you receive is up to you! If you foresee yourself needing or wanting higher monthly payouts, you should plan your savings such that you’ll have the necessary amount in your Retirement Account (RA) when you retire. When you know the amount to strive towards, the steps you need to achieve it become clearer!

To help you estimate how much to set aside, we have handy retirement calculators that do just that!

Retirement is an important milestone in life, and we all wish to be well-prepared when we finally reach it. We hope that with the three tips we’ve outlined today, you’ll be able to take your first steps towards a sweeter retirement!

Information in this article is accurate as at the date of publication.

.jpg)